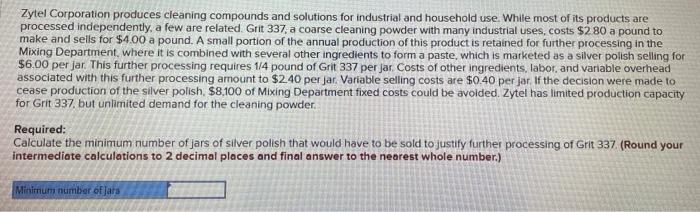

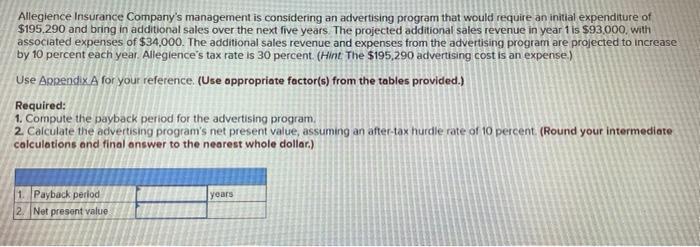

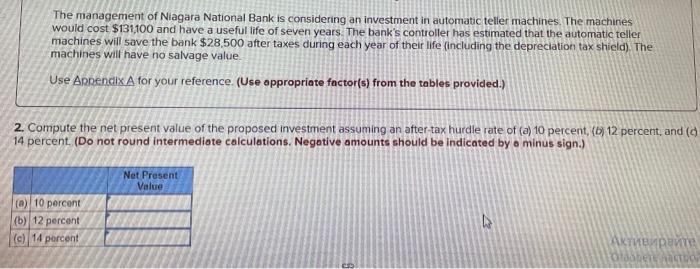

Zytel Corporation produces cleaning compounds and solutions for industrial and household use. While most of its products are processed independently, a few are related. Grit 337 , a coarse cleaning powder with many industrial uses, costs $280 a pound to make and sells for $4.00 a pound. A small portion of the annual production of this product is retained for further processing in the Mixing Department. where it is combined with several other ingredients to form a paste, which is marketed as a silver polish selling for $6.00 per jar. This further processing requires. 1/4 pound of Grit 337 per jar, Costs of other ingredients, labor, and variable overhead associated with this further processing amount to $2.40 per jar. Variable selling costs are $0.40 per jar. If the decision were made to cease production of the silver polish, $8,100 of Mixing Department fixed costs could be avolded. Zytel has limited production capacity for Grit 337, but unlirnited demand for the cleaning powder. Required: Calculate the minimum number of jars of silver polish that would have to be sold to justify further processing of Grit 337 . (Round your intermediate calculations to 2 decimal places and final answer to the nearest whole number.) Allegience Insurance Company's management is considering an advertising program that would require an initial expenditure of $195,290 and bring in additional sales over the next five years. The projected additional sales revenue in year 1 is 593,000 , With associated expenses of $34,000. The additional sales revenue and expenses from the advertising program are projected to increase by 10 percent each year. Allegience's tax rate is 30 percent. (Hint. The $195,290 advertising cost is an expense) Use AppendixA for your reference. (Use oppropriate factor(s) from the tables provided.) Required: 1. Compute the payback period for the advertising program, 2. Calculate the advertising program's net present value, assuming an after-tax hurdle rate of 10 percent. (Round your intermediate calculations and final onswer to the nearest whole dollar.) The management of Niagara National Bank is considering an investment in automatic teller machines. The machines would cost. $131,100 and have-a useful life of seven years. The bank's controller has estimated that the automatic teller machines will save the bank $28,500 after taxes during each year of their life (including the depreciation tax shicld). The machines wilt have no salvage value. Use ApnencixA for your reference. (Use appropriate factor(s) from the tables provided.) 2. Compute the net, present value of the proposed investment assuming an after-tax hurdle rate of (a) 10 percent, { bj 12 percent, and 14 percent. (Do not round intermediate calculations. Negative amounts should be indicated by a minus sign.)