Robust Properties is planning to go public by creating a REIT that will offer 1 million shares

Question:

Robust Properties

I. Major Financial Information:

a. Assets€”properties (actual cost) ............................................ $100,000,000

b. Depreciable basis€”buildings only .......................................... $80,000,000

c. Useful life .......................................................................................... 40 years

d. Operating expenses ................................................................. 38% of rents

e. Management expenses€”3rd parties ....................................... 5% of rents

f. General and administrative expenses ...................................... 3% of rents

g. Mortgage @ 8% interest only, 10 yrs. ..................................... $30,000,000

h. Financing fees ................................................................................ $900,000

II. Lease Information:

a. Average lease term ........................................................................... 5 years

b. Leasable space ......................................................................... 1,000,000sf.

c. Base rents (year 1) ........................................................................... $15 psf.

d. Escalation factor€”rents per year ........................................................... 5%

e. Lease commissions .............................................................. 4% of yr 1 rent

f. Tenant improvements ...................................................................... $10 psf.

The management of Robust Properties has asked you to prepare preliminary pro forma financials for the next three years. Specifically, you should have

(1) A beginning balance sheet,

(2) Operating statements for each of the next three years, and

(3) All relevant financial ratios for year 1 results only. Robust will pay all financing fees, tenant improvements, and lease commissions upon commencing operations. It would like to pay a minimum dividend of $4.00 per share.

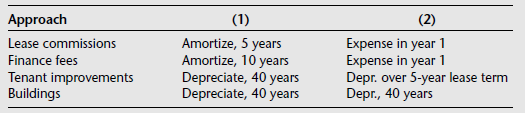

In preparing your pro forma operating statements, Robust wants you to consider the effects of reporting in the following two ways:

a. What would EPS, FFO, and ROC be under both approaches? How should Robust think about its accounting policy?

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Financial Ratios

The term is enough to curl one's hair, conjuring up those complex problems we encountered in high school math that left many of us babbling and frustrated. But when it comes to investing, that need not be the case. In fact, there are ratios that,...

Step by Step Answer:

Real Estate Finance and Investments

ISBN: 978-0073377339

14th edition

Authors: William Brueggeman, Jeffrey Fisher