The final parcel in the financial district has been placed for sale. It was owned by an

Question:

The final parcel in the financial district has been placed for sale. It was owned by an old Chicago family who is now looking to cash in on real estate holdings. The sale has been approved by the circuit court and the price agreed by the estate. As soon as probate concludes, fourth quarter 2019, the sale will be complete and development expected to begin, i.e. 1 January 2020. Given the length of time prior to sale completion, mobilization will be possible allowing for a rapid development/construction at 12 months.

Property description

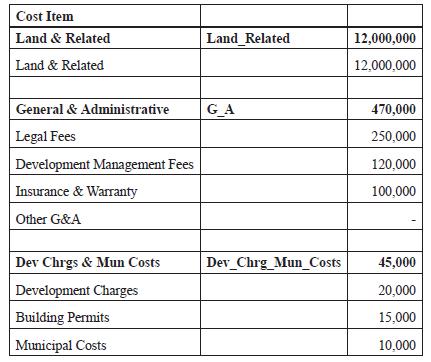

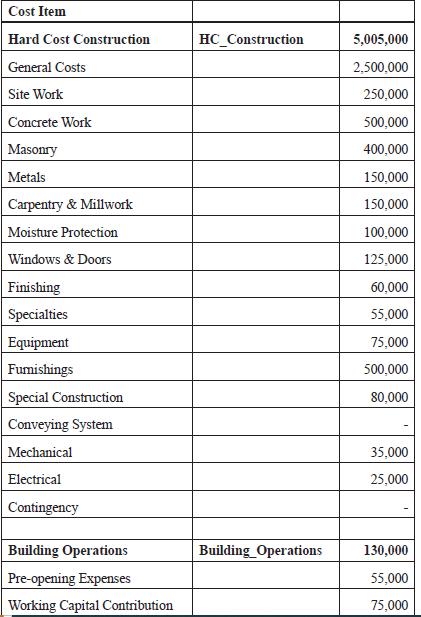

A 12-story hotel in the outskirts of the city. Land cost is \($12.0\) million and reminder of uses expected to be approximately \($6.2\) million. The property is located on a main thoroughfare and can service secondary markets as well as downtown Chicago.

Market description and performance

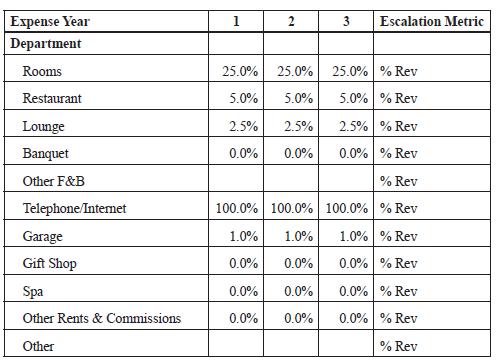

Chicago is a first-rate city with full service hotels and high expectations for clients. The vacancy rate is relatively low given the financial strength of the area. ADRs of \($115\), \($120\), and \($125\) POR are reasonable. Occupancy, given the absorption of the area, is expected at 75%, 80%, and 85% for the first three years. Given the transient nature of the area and high business clients, revenues in the area of Food and Beverage, lounge, and banquet per occupied room are expected to be the following for the first three years: (Restaurant: \($15\), \($16\), \($17\); Lounge: \($5\), \($5\), \($5\); Banquet: \($4\), \($5\), \($6\)). (Note: Banquet is Per Banquet Square Feet (PBSF).) Other departments are expected to contribute to hotel revenues as well. Telephone/

Internet at \($2\)/POR, Garage at \($7.50\)/POR, and Gift Shop \($1\)/POR.

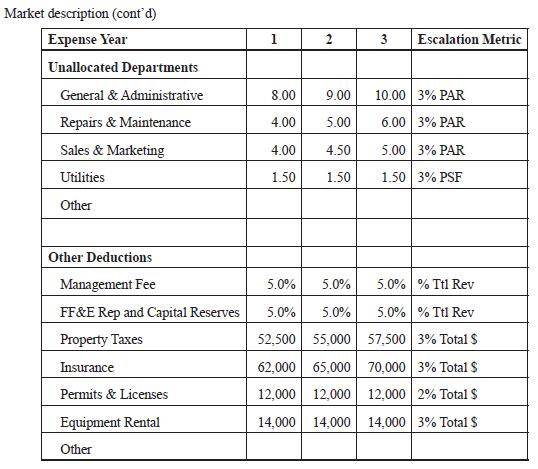

Escalation assumptions

A conservative approach should be taken in Chicago. The Federal Reserve will have inflation back to its intended target of 2.00%. This metric is modelled for forecasting.

Case study assignment

Your goal is to construct a hotel and analyze the project:

• Maximum purchase price of land is \($15.0\) million • Minimum 10-year IRR 10.00%

• Ten-year time horizon for exit.

Issues to consider:

• What is the probability that the money will be returned in year 10 if there is a significant global recession?

• What if occupancy numbers are 15.0% too high?

• What if the Chicago market is unable to support ADRs as forecast? How low can the hotel support?

• What is a reasonable exit capitalization rate?

Step by Step Answer:

Foundations Of Real Estate Financial Modelling

ISBN: 9781138046184

2nd Edition

Authors: Roger Staiger