A fund's risk appetite is such that it wants to be 90% certain that it will not

Question:

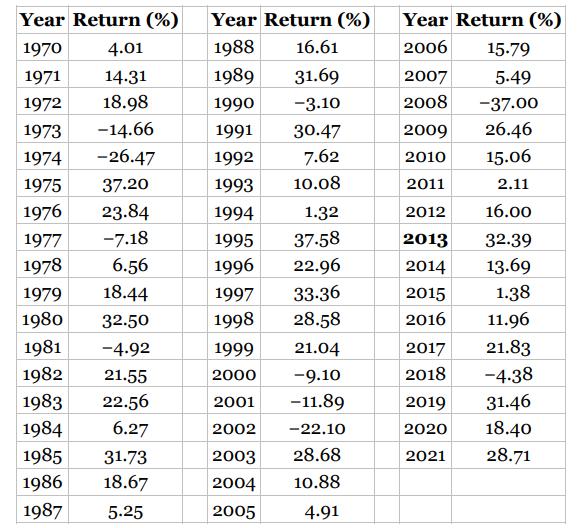

A fund's risk appetite is such that it wants to be 90% certain that it will not lose more than 20% in any one year. Using the performance of the S&P 500 between 1970 and 2021 (see Table 24.1), determine the beta the fund should have. Assume a risk‐free rate of 3% per annum.

Table 24.1

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: