Calculate the interest rate paid by MdP six years after the beginning of the deal in Business

Question:

Calculate the interest rate paid by MdP six years after the beginning of the deal in Business Snapshot 24.2 if the Euribor rate proves to be 8% from year 2 onward.

Transcribed Image Text:

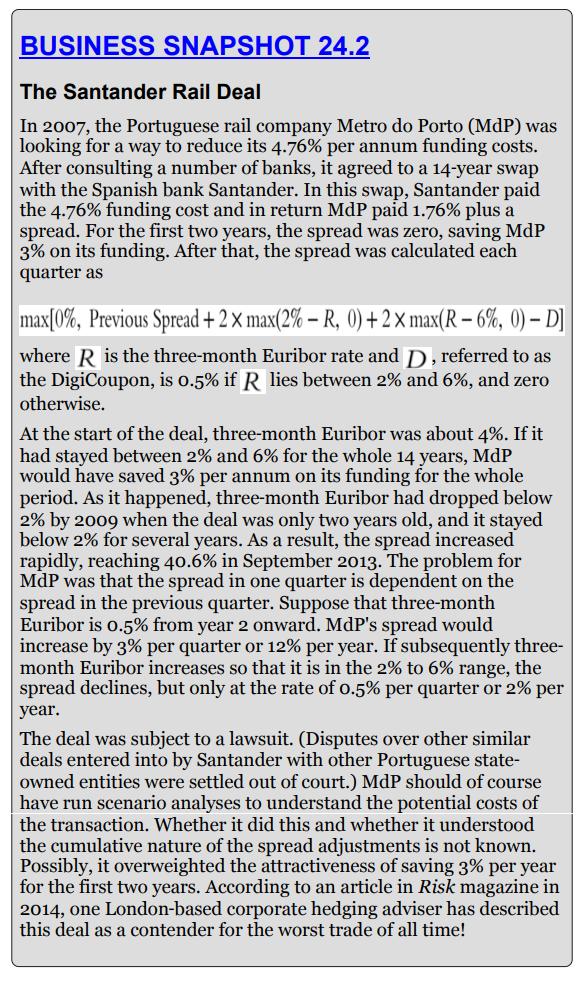

BUSINESS SNAPSHOT 24.2 The Santander Rail Deal In 2007, the Portuguese rail company Metro do Porto (MdP) was looking for a way to reduce its 4.76% per annum funding costs. After consulting a number of banks, it agreed to a 14-year swap with the Spanish bank Santander. In this swap, Santander paid the 4.76% funding cost and in return MdP paid 1.76% plus a spread. For the first two years, the spread was zero, saving MdP 3% on its funding. After that, the spread was calculated each quarter as max[0%, Previous Spread + 2 x max(2%-R, 0) + 2x max(R-6%, 0)-D] where R is the three-month Euribor rate and D, referred to as the DigiCoupon, is 0.5% if R lies between 2% and 6%, and zero otherwise. At the start of the deal, three-month Euribor was about 4%. If it had stayed between 2% and 6% for the whole 14 years, MdP would have saved 3% per annum on its funding for the whole period. As it happened, three-month Euribor had dropped below 2% by 2009 when the deal was only two years old, and it stayed below 2% for several years. As a result, the spread increased rapidly, reaching 40.6% in September 2013. The problem for MdP was that the spread in one quarter is dependent on the spread in the previous quarter. Suppose that three-month Euribor is 0.5% from year 2 onward. MdP's spread would increase by 3% per quarter or 12% per year. If subsequently three- month Euribor increases so that it is in the 2% to 6% range, the spread declines, but only at the rate of 0.5% per quarter or 2% per year. The deal was subject to a lawsuit. (Disputes over other similar deals entered into by Santander with other Portuguese state- owned entities were settled out of court.) MdP should of course have run scenario analyses to understand the potential costs of the transaction. Whether it did this and whether it understood the cumulative nature of the spread adjustments is not known. Possibly, it overweighted the attractiveness of saving 3% per year for the first two years. According to an article in Risk magazine in 2014, one London-based corporate hedging adviser has described this deal as a contender for the worst trade of all time!

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Each quarter from year 2 o...View the full answer

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Assume that in Business Snapshot 27.1, the change in the three-month Euribor rate in each quarter, is normally distributed with mean zero and a standard deviation equal to x basis points. Use Monte...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

What does a SWOT analysis reveal about the overall attractiveness of lululemon's situation?

-

What are the advantages and disadvantages to a firm that issues low- or zero-coupon bonds?

-

Kurta Company Ltd. has a budget of $10 million for new projects. The projects are independent and have the following costs and profitability indexes associated with them: a. Make your selection under...

-

3. Assume that Pop Corporation acquires 60 percent of the voting common stock of Son Corporation for $6,000,000 and that a consolidated balance sheet is prepared immediately after the acquisition....

-

A 3.00-m-long, 240-N, uniform rod at the zoo is held in a horizontal position by two ropes at its ends (Fig. 11.30). The left rope makes an angle of 150° with the rod and the right rope makes an...

-

there are 5 journal entries in this question and please solve it according to those please fill up all the empty boxes according to the pattern given. Buffalo Landscaping Limited has determined that...

-

A fund's risk appetite is such that it wants to be 97.5% certain it will not lose more than 25% in any one year. Using the performance of the S&P 500 between 1970 and 2021 (see Table 24.1), determine...

-

A fund's risk appetite is such that it wants to be 90% certain that it will not lose more than 20% in any one year. Using the performance of the S&P 500 between 1970 and 2021 (see Table 24.1),...

-

State whether each set of hypotheses is valid for a statistical test. If not valid, explain why not. (a) H 0 : = 15 vs H a : 15 (b) H 0 : p 0.5 vs H a : p = 0.5 (c) H 0 : p 1 < p 2 vs H a : p 1 >...

-

Q2 2 Points The time between students pinging professor with questions during an exam is modeled by an exponential random variable X (measured in minutes) with parameter (usual notation) Q2.1 1 Point...

-

A. Describe what the formula P = M A E represents. B. What happens if one of these factors becomes deficient? C. In terms of performance, identify the four different types of reinforcement. Provide...

-

1-3.2) K Question 10, 3.1.37 Part 1 of 6 > HW Score: 53.33%, 6.4 of 12 points O Points: 0 of 1 Save Because the mean is very sensitive to extreme values, it is not a resistant measure of center. By...

-

Research the company and obtain the following information: Mission Statement - Purpose of their existence Goals and objectives (What are they in business for) SWOT analysis for this company Based on...

-

please write one page for the concept of organizational structure one page paper of factors affecting organizational structure.

-

Describe examples of each of the management functions illustrated in this case.

-

What are three disadvantages of using the direct write-off method?

-

Relate the concept of stock turnover to the growth of mass-merchandising. Use a simple e x ample in your answer.

-

Discuss the idea of drawing separate demand curves for different market segments. It seems logical because each target market should have its own marketing mix. But wont this lead to many demand...

-

Distinguish between leader pricing and bait pricing. What do they have in common? How can their use affect a marketing mix?

-

Question 24 Not yet answered Marked out of 1.00 P Flag question Muscat LLC's current assets and current liabilities are OMR 258,000 and OMR 192,000, respectively. In the year 2020, the company earned...

-

Question 24 Miami Company sold merchandise for which it received $710,400, including sales and excise taxes. All of the firms sales are subject to a 6% sales tax but only 50% of sales are subject to...

-

f the IRS intends to close a Taxpayer Assistance Center, they must notify the public at least _____ days in advance of the closure date. 14 30 60 90

Study smarter with the SolutionInn App