Emily, who is single, sustains an NOL of $7,800 in 2021. The loss is carried forward to

Question:

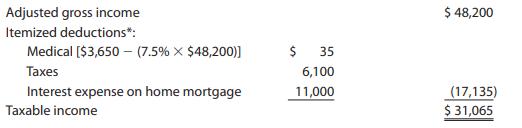

Emily, who is single, sustains an NOL of $7,800 in 2021. The loss is carried forward to 2022. For 2022, Emily’s income tax information before taking into account the 2021 NOL is as follows:

*The 2021 single standard deduction is $12,550; Emily’s itemized deductions will exceed the 2022 single standard deduction (after adjustment for inflation).

How much of the NOL carryforward can Emily use in 2022, and what is her adjusted gross income and her taxable income?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2022 Individual Income Taxes

ISBN: 9780357519073

45th Edition

Authors: James C. Young, Annette Nellen, William A. Raabe, Mark Persellin, William H. Hoffman

Question Posted: