Coline has the following capital gain and loss transactions for 2022: After the capital gain and loss

Question:

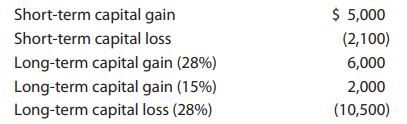

Coline has the following capital gain and loss transactions for 2022:

After the capital gain and loss netting process, what is the amount and character of Coline’s gain or loss?

Transcribed Image Text:

Short-term capital gain Short-term capital loss Long-term capital gain (28%) Long-term capital gain (15%) Long-term capital loss (28%) $ 5,000 (2,100) 6,000 2,000 (10,500)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

Coline first nets the shortterm gains and losses against ea...View the full answer

Answered By

Shehar bano

I have collective experience of more than 7 years in education. my area of specialization includes economics, business, marketing and accounting. During my study period I remained engaged with a business school as a visiting faculty member and did a lot of business research. I am also tutoring and mentoring number of international students and professionals online for the last 7 years.

5.00+

4+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2023 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357720103

26th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

Coline has the following capital gain and loss transactions for 2015. Short-term capital gain ......................................... $ 5,000 Short-term capital loss...

-

Coline has the following capital gain and loss transactions for 2017. After the capital gain and loss netting process, what is the amount and character of Colines gain or loss? Short-term capital...

-

Coline has the following capital gain and loss transactions for 2016. Short-term capital gain .................................. $ 5,000 Short-term capital loss ......................................

-

For the year ending December 31, Orion, Inc. mistakenly omitted adjusting entries for $1,500 of supplies that were used, (2) unearned revenue of $4,200 that was earned, and (3) insurance of $5,000...

-

State whether actual (A) or estimated (E) costs are more likely to be used to carry out the following activities: calculate taxes, make bids, pay bonuses, determine profit or loss, predict sales, set...

-

Do you think it is possible to identify 'best practice' in payment policy? What elements would you consider should make up any such package? LO7

-

Abnormal gain should reduce normal loss.

-

Terry Kunkle and VanBuren High hosted a Christmas party in Berkeley County, South Carolina. Guests had drinks and hors doeuvres at a residence and adjourned to dinner in a barn across a public road....

-

QS 19-17 Absorption costing and product pricing LO P4 A manufacturer reports the following information on its product. 1.25 points eBook Direct materials cost Direct labor cost Variable overhead cost...

-

Stanford owns and operates two dry cleaning businesses. He travels to Boston to discuss acquiring a restaurant. Later in the month, he travels to New York to discuss acquiring a bakery. Stanford does...

-

Jesse completes the following capital asset transactions. By how much does Jesses AGI increase/decrease as a result of these gains/losses? Long-term gain Short-term gain Short-term loss $10,000...

-

Which SQL statement would give user cyclone1 the ability to select, insert, update, or delete records from the Students table? a. GRANT SELECT, INSERT on STUDENTS to cyclone1 b. GRANT ALL on STUDENTS...

-

Give an example of a program that will cause a branch penalty in the three-segment pipeline of Sec. 9-5. Example: Three-Segment Instruction Pipeline A typical set of instructions for a RISC processor...

-

Are Google, Microsoft, and Apple acting ethically? Are they being socially responsible? Eager to benefit from the economic growth and the job creation that foreign direct investments generate, many...

-

On May 1, 2011, Lenny's Sandwich Shop loaned \$20,000 to Joe Lopez for one year at 6 percent interest. Required Answer the following questions: a. What is Lenny's interest income for 2011? b. What is...

-

Tipton Corporations balance sheet indicates that the company has \($300,000\) invested in operating as sets. During 2006, Tipton earned operating income of \($45,000\) on \($600,000\) of sales....

-

Norton Car Wash Co. is considering the purchase of a new facility. It would allow Norton to increase its net income by \($90,000\) per year. Other information about this proposed project follows:...

-

Why segregate a balance sheet by type of asset and type of liability?

-

TRUE OR FALSE: 1. Banks with a significantly large share of fixed-interest rate home loans are less exposed to interest rate risks. 2. Although Australian banks are pretty big, they are not...

-

Carmen SanDiego, a U.S. citizen, is employed by General Motors Corporation, a U.S. corporation. On April 1, 2019, GM relocated Carmen to its Brazilian operations for the remainder of 2019. Carmen was...

-

Guido is a citizen and resident of Belgium. He has a full-time job in Belgium and has lived there with his family for the past 10 years. In 2017, Guido came to the United States for the first time....

-

Wood Corporation was a C corporation in 2018 but elected to be taxed as an S corporation in 2019. At the end of 2018, its earnings and profits were $15,500. The following table reports Wood Corp.s...

-

(1 point) Bill makes annual deposits of $1900 to an an IRA earning 5% compounded annually for 14 years. At the end of the 14 years Bil retires. a) What was the value of his IRA at the end of 14...

-

Which of the following concerning short-term financing methods is NOT CORRECT? Short-term bank loans typically do not require assets as collateral. Firms generally have little control over the level...

-

Kingbird Corporation is preparing its December 31, 2017, balance sheet. The following items may be reported as either a current or long-term liability. 1. On December 15, 2017, Kingbird declared a...

Study smarter with the SolutionInn App