Jesse completes the following capital asset transactions. By how much does Jesses AGI increase/decrease as a result

Question:

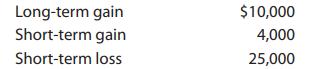

Jesse completes the following capital asset transactions. By how much does Jesse’s AGI increase/decrease as a result of these gains/losses?

Transcribed Image Text:

Long-term gain Short-term gain Short-term loss $10,000 4,000 25,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (8 reviews)

Jesse has a longterm capital gain of 10000 and ...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2023 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357720103

26th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Lefty completes the following capital asset transactions. By how much does Lefty's AGI increase as a result of these gains/losses? Long-term gain $10,000 Short-term gain 4,000 Short-term loss 25,000

-

A bakery with a December 31 st year end purchased new equipment on October 31 st 2000 for $10,000. This was their first equipment purchase. Required: What are the tax consequences if the equipment is...

-

ABS plastic is a tough, hard plastic used in applications requiring shock resistance. The polymer consists of three monomer units: acrylonitrile (C3H3N), butadiene (C4H6, and styrene (C8H8). a. Draw...

-

Classify the following cost elements as first cost (FC) components or annual operating cost (AOC) components for a piece of equipment on the shop floor: supplies, insurance, equipment cost, utility...

-

Can payment ever be truly fair? LO7

-

In process costing, ordinarily no distinction is made between direct and indirect materials.

-

On January 1, 2013, Plains Power Company overhauled four turbine engines that generate power for customers. The overhaul resulted in a slight increase in the capacity of the engines to produce power....

-

Could you please answer this question? I am in a hurry a little bit, so fast answer would be appreciated! Thank you! Question 14 (1 point) Amtrek Inc. is planning to dispose of a collection of...

-

Coline has the following capital gain and loss transactions for 2022: After the capital gain and loss netting process, what is the amount and character of Colines gain or loss? Short-term capital...

-

Facegram, Inc., reported net cumulative favorable book-tax temporary differences of $1,000,000 at the end of 2021. During 2022, legislation was enacted that will increase Facegrams tax rate from 21%...

-

Draw an isoquant-isocost line graph to illustrate the following situation: Jill Johnson can rent pizza ovens for $400 per week and hire workers for $200 per week. She is currently using 5 ovens and...

-

Lennys Limousine Service (LLS) is considering the purchase of two Hummer limousines. Various information about the proposed investment follows: Required: Help LLS evaluate this project by calculating...

-

Lancer Corp. has the following information available about a potential capital investment Required: 1. Calculate the projects net present value. 2. Without making any calculations, determine whether...

-

Woodchuck Corp. is considering the possibility of outsourcing the production of upholstered chair pads included with some of its wooden chairs. The company has received a bid from Padalong Co. to...

-

Woodchuck Corp. is considering eliminating a product from its line of outdoor tables. Two products, the Oak-A and Fiesta tables, have impressive sales. However, sales for the Studio model have been...

-

Suppose that Flyaway Company also produces the Windy model fan, which currently has a net loss of \($40,000\) as follows: Eliminating the Windy product line would eliminate \($20,000\) of direct...

-

What is household equity, and how do you calculate it?

-

Refer to the information from Exercise 22-19. Use the information to determine the (1) Weighted average contribution margin , (2) Break-even point in units, and (3) Number of units of each product...

-

Tempe Corporation is a calendar-year corporation. At the beginning of 2019, its election to be taxed as an S corporation became effective. Tempe Corp.s balance sheet at the end of 2018 reflected the...

-

Virginia Corporation is a calendar-year corporation. At the beginning of 2019, its election to be taxed as an S corporation became effective. Virginia Corp.s balance sheet at the end of 2018...

-

Rivendell Corporation uses the accrual method of accounting and has the following assets as of the end of 2018. Rivendell converted to an S corporation on January 1, 2019. a. What is Rivendells net...

-

BE13.2 (LO 1), AP An inexperienced accountant for Silva Corporation showed the following in the income statement: net income \$337,500 and unrealized gain on availablefor-sale securities (before...

-

A start - up company is seeking $ 5 m for its Series A investment round. The start - up is expected to grow to $ 1 0 0 M in sales and $ 1 0 M in profit by year 5 . Comparable firms in the industry...

-

Here are the cash flows for a project under consideration: C 0 C 1 C 2 $8,010 +$5,940 +$20,160 a. Calculate the projects net present value for discount rates of 0, 50%, and 100%. (Round your answers...

Study smarter with the SolutionInn App