Egret Corporation, a calendar year C corporation, was formed on March 6, 2022, and opened for business

Question:

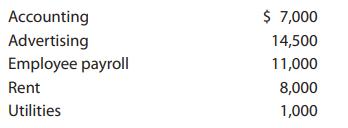

Egret Corporation, a calendar year C corporation, was formed on March 6, 2022, and opened for business on July 1, 2022. After its formation but prior to opening for business, Egret incurred the following expenditures:

What is the maximum amount of these expenditures that Egret can deduct in 2022?

Transcribed Image Text:

Accounting Advertising Employee payroll Rent Utilities $ 7,000 14,500 11,000 8,000 1,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (7 reviews)

All 41500 of the expenditures are startup expenditures Egret can ...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2023 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357720103

26th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

Egret Corporation, a calendar year C corporation, was formed on March 7, 2013, and opened for business on July 1, 2013. After its formation but prior to opening for business, Egret incurred the...

-

Egret Corporation, a calendar year C corporation, was formed on March 6, 2016, and opened for business on July 1, 2016. After its formation but prior to opening for business, Egret incurred the...

-

Egret Corporation, a calendar year C corporation, was formed on March 6, 2015, and opened for business on July 1, 2015. After its formation but prior to opening for business, Egret incurred the...

-

Khairul has been working with Tun Hamid Energy Bhd since 1 February 2009 as a Human Resource Executive. Beginning 1 January 2014, he was promoted as Human Resource Manager. Details of his...

-

The equipment required to place 160 cubic yards of concrete by experienced workers is two gasoline engine vibrators and one concrete pump. If the vibrators cost $76 per day and the concrete pump...

-

If you were asked to develop a new job evaluation scheme for an organisation with which you are familiar, which six of these factors would you choose to use as its basis? How would you weight each...

-

Process costing is applied in garment industry.

-

Transactions related to revenue and cash receipts completed by Main Line Inc. during the month of August 2012 are as follows: Aug. 2. Issued Invoice No. 512 to Boston Co., $780. 4. Received cash from...

-

Corp. prepared a master budget that included $14.245 for direct materials, $28,500 for direct bo, 50.20 for $39,300 for fixed overhead. Delaware Corp. planned to sell 4,070 units during the period,...

-

Broadbill Corporation, a calendar year C corporation, has two unrelated cash method shareholders: Marcia owns 51% of the stock, and Zack owns the remaining 49%. Each shareholder is employed by the...

-

Lupe, a cash basis taxpayer, owns 55% of the stock of Jasper Corporation, a calendar year accrual basis C corporation. On December 31, 2022, Jasper accrues a performance bonus of $100,000 to Lupe...

-

Give null and alternative hypotheses for a population proportion, as well as sample results. Use StatKey or other technology to generate a randomization distribution and calculate a p-value. StatKey...

-

When a supersonic airflow, \(M=1.8\), passes through a normal shockwave under sea level conditions, what are the values of the stagnation pressure before and after the normal shockwave?

-

Eastern University, located in central Canada, prides itself on providing faculty and staff with a competitive compensation package. One aspect of this package is a tuition benefit of \($4,000\) per...

-

What is the formula for calculating return on investment (ROI)?

-

Air enters a 5.5-cm-diameter adiabatic duct with inlet conditions of \(\mathrm{Ma}_{1}=2.2, T_{1}=250 \mathrm{~K}\), and \(P_{1}=60 \mathrm{kPa}\), and exits at a Mach number of...

-

At the various activity levels shown, Taylor Company incurred the following costs. Required: Identify each of these costs as fixed, variable, or mixed. Units sold 20 40 60 80 100 a. Total salary cost...

-

Is an increase in debt a plus or minus from a cash flow standpoint? Explain.

-

In your readings, there were many examples given for nurturing close family relationships in this ever-evolving technological society we live in Based upon your readings and research describe three...

-

Jackson and Ashley Turner (both 45 years old) are married and want to contribute to a Roth IRA for Ashley. In 2019, their AGI is $197,000. Jackson and Ashley each earned half of the income. a. How...

-

In 2019, Rashaun (62 years old) retired and planned on immediately receiving distributions (making withdrawals) from his traditional IRA account. The balance of his IRA account is $160,000 (before...

-

In 2019, Susan (44 years old) is a highly successful architect and is covered by an employee-sponsored plan. Her husband, Dan (47 years old), however, is a Ph.D. student and unemployed. Compute the...

-

Wendell's Donut Shoppe is investigating the purchase of a new $39,600 conut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings...

-

1.Discuss the challenges faced with Valuing Stocks and Bonds. As part of this discussion, how will the selected item be implemented in an organization and its significance? 2. Discuss how Valuing...

-

help me A 35% discount on 3 smart phone amounts to $385. What is the phone's list price? Answer =$ (rounded to the nearest cent)

Study smarter with the SolutionInn App