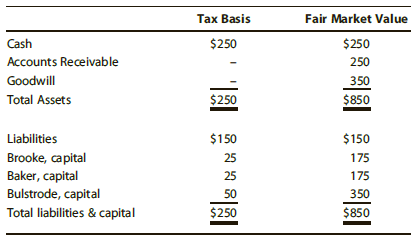

Brooke, Baker, and Bulstrode own 25%, 25%, and 50% interests, respectively, in the BBB Partnership. BBB is

Question:

Assume that liabilities are shared proportionately by the partners and that each partner€™s capital account equals the partner€™s basis before considering liabilities. On the balance sheet date, Brooke purchases Baker€™s 25% interest in the partnership, paying Baker $175 cash and assuming Baker€™s share of the partnership liabilities. As a result of this buyout of her partnership interest, what is the total gain on sale that Baker should report on her individual tax return?

a. $112.50

b. $150.00

c. $187.50

d. $212.50

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2018 Corporations Partnerships Estates And Trusts

ISBN: 1389

41st Edition

Authors: William H. Hoffman, William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

Question Posted: