Coline has the following capital gain and loss transactions for 2015. After the capital gain and loss

Question:

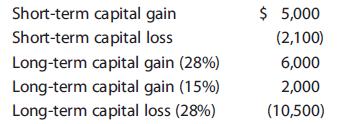

Coline has the following capital gain and loss transactions for 2015.

After the capital gain and loss netting process, what is the amount and character of Coline’s gain or loss?

Transcribed Image Text:

Short-term capital gain Short-term capital loss Long-term capital gain (28%) Long-term capital gain (15%) Long-term capital loss (28%) $ 5,000 (2,100) 6,000 2,000 (10,500)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

To determine the amount and character of Colines net capital gain or loss after the capital gain and ...View the full answer

Answered By

Ma Kristhia Mae Fuerte

I have extensive tutoring experience, having worked as a private tutor for over three years. I have tutored students from different academic levels, including high school, undergraduate, and graduate levels. My tutoring experience has taught me to be patient, attentive to student needs, and effective in communicating difficult concepts in simple terms.

I have a strong background in statistics, probability theory, data analysis, and data visualization. I am proficient in using statistical software such as R, Python, and SPSS, which are commonly used in academic research and data analysis. Additionally, I have excellent communication and interpersonal skills, which enable me to establish rapport with students, understand their learning styles, and adapt my teaching approach to meet their needs.

I am passionate about teaching and helping students achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2016 Individual Income Taxes

ISBN: 9781305393301

39th Edition

Authors: James H. Boyd, William H. Jr. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Coline has the following capital gain and loss transactions for 2017. After the capital gain and loss netting process, what is the amount and character of Colines gain or loss? Short-term capital...

-

Coline has the following capital gain and loss transactions for 2015. Short-term capital gain ......................................... $ 5,000 Short-term capital loss...

-

Coline has the following capital gain and loss transactions for 2016. Short-term capital gain .................................. $ 5,000 Short-term capital loss ......................................

-

In 2020, Neighbor Co-Op Inc. sells 1,100 beverages in glass bottles and receives a $1.00 deposit for each returnable bottle sold. As of December 31, 2020, a total of 880 glass bottles were returned...

-

The APT itself does not provide guidance concerning the factors that one might expect to determine risk premiums. How should researchers decide which factors to investigate? Why, for example, is...

-

What were the most critical moments during the project?

-

P 16-13 Recording new partner investmentComplex non-revaluation and revaluation cases A condensed balance sheet for the Pet, Qua, and She partnership at December 31, 2016, and their profitand...

-

Mason Co. issued $60,000,000 of five-year, 14% bonds with interest payable semiannually, at an effective interest rate of 10%. Determine the present value of the bonds payable, using the present...

-

Cane Company manufactures two products called Alpha and Beta that sell for $125 and $85, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the...

-

Fly-by-Night is an international airline company. Its fleet includes Boeing 757s, 747s, 727s, Lockheed L-1011s, and McDonnell Douglas MD-83s, MD-80s, and DC-9s. Assume that Fly-by-Night made the...

-

Elliott has the following capital gain and loss transactions for 2015. After the capital gain and loss netting process, what is the amount and character of Elliotts gain or loss? Short-term capital...

-

Olivia wants to buy some vacant land for investment purposes. She cannot afford the full purchase price. Instead, Olivia pays the landowner $8,000 to obtain an option to buy the land for $175,000...

-

Addison Co. has one temporary difference at the beginning of 2012 of $500,000. The deferred tax liability established for this amount is $150,000, based on a tax rate of 30%. The temporary difference...

-

Construct a 90% confidence interval for the population standard deviation o at Bank B. Bank B 4.2 5.4 5.9 6.1 6.6 7.7 7.7 8.6 9.3 10.0

-

Jamila Traders has a head office in Nanyuki and an autonomous branch in Thika. The trial balances of the head office and the branch as at 30 September 2014 were as follows: Head office Sh. Sh. Thika...

-

Poll Results in the Media USA Today provided results from a survey of 1144 Americans who were asked if they approve of Brett Kavanaugh as the choice for Supreme Court justice. 51% of the respondents...

-

ROI analysis using the DuPont model a. Firm A has a margin of 7%, sales of $980,000, and ROI of 19.6%. Calculate the firm's average total assets. b. Firm B has net income of $259,200, turnover of...

-

The test statistic of z = - 2.93 is obtained when testing the claim that p < 2/ 3. This is a left-tailed test. Using a 0.01 significance level, complete parts (a) and (b). a. Find the critical...

-

The following are partial income statement account balances taken from the December 31, 2018, year-end trial balance of White and Sons, Inc.: restructuring costs, $300,000; interest revenue, $40,000;...

-

The first national bank pays a 4% interest rate compound continuously. The effective annual rate paid by the bank is __________. a. 4.16% b. 4.20% c. 4.08% d. 4.12%

-

A personal service corporation (PSC) generally is limited to the calendar year for reporting purposes. One exception to this rule is when the PSC can demonstrate a business purpose for a fiscal...

-

A new client, John Dobson, recently formed Johns Premium Steakhouse, Inc., to operate a new restaurant. The restaurant will be a first-time business venture for John, who recently retired after 30...

-

A new client, John Dobson, recently formed Johns Premium Steakhouse, Inc., to operate a new restaurant. The restaurant will be a first-time business venture for John, who recently retired after 30...

-

Docs Auto Body has budgeted the costs of the following repair time and parts activities for 2009: Doc's budgets 6,000 hours of repair time in 2009. A profit margin of $7 per labour hour will be added...

-

QUESTION 28 In a perpetual inventory system, the cost of inventory sold is: Debited to accounts receivable. Debited to cost of goods sold. O Not recorded at the time goods are sold. O Credited to...

-

The following financial statements and additional information are reported. IKIBAN INC. Comparative Balance Sheets June 30, 2019 and 2018 2019 2018 $105,709 69,500 66,800 4,700 246,700 127,eee...

Study smarter with the SolutionInn App