Elliott has the following capital gain and loss transactions for 2015. After the capital gain and loss

Question:

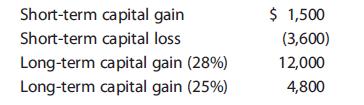

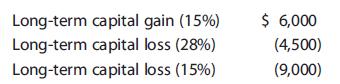

Elliott has the following capital gain and loss transactions for 2015.

After the capital gain and loss netting process, what is the amount and character of Elliott’s gain or loss?

Transcribed Image Text:

Short-term capital gain Short-term capital loss Long-term capital gain (28%) Long-term capital gain (25%) $ 1,500 (3,600) 12,000 4,800

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (8 reviews)

To calculate Elliotts net capital gain or loss for 2015 we need to follow these steps Net the shortt...View the full answer

Answered By

Abdul Wahab Qaiser

Before working at Mariakani, I volunteered at a local community center, where I tutored students from diverse backgrounds. I helped them improve their academic performance and develop self-esteem and confidence. I used creative teaching methods, such as role-playing and group discussions, to make the learning experience more engaging and enjoyable.

In addition, I have conducted workshops and training sessions for educators and mental health professionals on various topics related to counseling and psychology. I have presented research papers at conferences and published articles in academic journals.

Overall, I am passionate about sharing my knowledge and helping others achieve their goals. I believe that tutoring is an excellent way to make a positive impact on people's lives, and I am committed to providing high-quality, personalized instruction to my students.

0.00

0 Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2016 Individual Income Taxes

ISBN: 9781305393301

39th Edition

Authors: James H. Boyd, William H. Jr. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Elliott has the following capital gain and loss transactions for 2017. After the capital gain and loss netting process, what is the amount and character of Elliotts gain or loss? $ 1,500 Short-term...

-

Elliott has the following capital gain and loss transactions for 2015. Short-term capital gain .......................................... $ 1,500 Short-term capital loss...

-

Elliott has the following capital gain and loss transactions for 2016. Short-term capital gain .................................. $ 1,500 Short-term capital loss ......................................

-

Instructions In simplified form, you are going to be producing a script. The script will create 2 tables, load the 2 tables with data and then using PL/SQL it will process those 2 tables and with 2...

-

If the APT is to be a useful theory, the number of systematic factors in the economy must be small. Why?

-

Which success factors were confirmed?

-

3. Prepare a profit distribution schedule for the Par and Boo partnership assuming monthly salary allowances of $800 and $1,000 for Par and Boo, respectively; interest allowances at a 12 percent...

-

An individual has $35,000 invested in a stock with a beta of 0.8 and another $40,000 invested in a stock with a beta of 1.4. If these are the only two investments in her portfolio, what is her...

-

Home Properties is developing a subdivision that includes 430 home lots. The 170 lots in the Canyon section are below a ridge and do not have views of the neighboring canyons and hills; the 260 lots...

-

The following is the statement of financial position of Rasheed Brothers Corporation (amounts in thousands). Instructions Evaluate the statement of financial position presented. State briefly the...

-

George is the owner of numerous classic automobiles. His intention is to hold the automobiles until they increase in value and then sell them. He rents the automobiles for use in various events...

-

Coline has the following capital gain and loss transactions for 2015. After the capital gain and loss netting process, what is the amount and character of Colines gain or loss? Short-term capital...

-

The motorcycle and rider have a total mass of 900 kg and mass center at G. Determine the minimum coefficient of static friction between the rear wheel and the slope in order for the rider to perform...

-

A storeroom is used to organize items stored in it on N shelves. Shelves are numbered from 0 to N-1. The K-th shelf is dedicated to items of only one type, denoted by a positive integer A[K]....

-

CASES CASE 10.1 Money in Motion Jake Nguyen runs a nervous hand through his once finely combed hair. He loosens his once perfectly knotted silk tie. And he rubs his sweaty hands across his once...

-

(3.8) Axiom, Definition of false false = true (3.9) Axiom, Distributivity of over : (pq) p=q

-

The board of directors of Unilever has been impressed by the presentation you did, and they further instructed you to conduct a more insightful investigation about the Sri Lankan market. They have...

-

The sample space listing the eight simple events that are possible when a couple has three children is {bbb, bbg, bgb, ogg, gbb, gbg, ggb, ggg}. After identifying the sample space for a couple having...

-

On December 31, 2018, the end of the fiscal year, Revolutionary Industries completed the sale of its robotics business for $9 million. The business segment qualifies as a component of the entity...

-

Express mass density in kg/m3 and weight density in lb/ft3. 1. Find the mass density of a chunk of rock of mass 215 g that displaces a volume of 75.0 cm3 of water. 2. A block of wood is 55.9 in. x...

-

A personal service corporation (PSC) generally is limited to the calendar year for reporting purposes. One exception to this rule is when the PSC can demonstrate a business purpose for a fiscal...

-

A personal service corporation (PSC) generally is limited to the calendar year for reporting purposes. One exception to this rule is when the PSC can demonstrate a business purpose for a fiscal...

-

A personal service corporation (PSC) generally is limited to the calendar year for reporting purposes. One exception to this rule is when the PSC can demonstrate a business purpose for a fiscal...

-

Read the following and then answer the questions below:September 12: A Brisbane business offers by letter to sell 500 tyres to a New Zealand company. The Brisbane company does not specify a method of...

-

Fred returns home from work one day to discover his house surrounded by police. His wife is being held hostage and threatened by her captor. Fred pleads with the police to rescue her and offers...

-

Would like you to revisit one of these. Consideration must be clear and measurable.if you can't measure it then how can you show it has / has not been done?How can you sue someone for breach of...

Study smarter with the SolutionInn App