In each of the following independent situations, determine the corporations income tax liability. Assume that all corporations

Question:

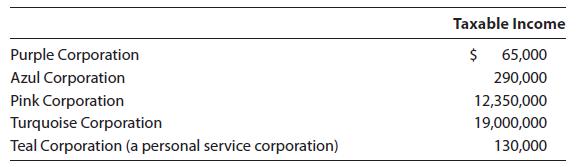

In each of the following independent situations, determine the corporationâs income tax liability. Assume that all corporations use a calendar year for tax purposes and that the tax year involved is 2022.

Transcribed Image Text:

Purple Corporation Azul Corporation Pink Corporation Turquoise Corporation Teal Corporation (a personal service corporation) Taxable Income $ 65,000 290,000 12,350,000 19,000,000 130,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

A flat rate of 21 applies to all C corporations including PSCs ...View the full answer

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

In each of the following independent situations, determine the corporation's income tax liability. Assume that all corporations use a calendar year for tax purposes and that the tax year involved is...

-

In each of the following independent situations, determine the corporations income tax liability. Assume that all corporations use a calendar year for tax purposes and that the tax year involved is...

-

In each of the following independent situations, determine the corporations income tax liability. Assume that all corporations use a calendar year for tax purposes and that the tax year involved is...

-

In Exercises verify the identity. coshx = 1 + cosh 2x 2

-

How do training activities differ between end users and system operators?

-

What is the P-FIT theory of intelligence?

-

3. The city sold general fixed assets with an original cost of $300,000 for $30,000 at the end of their useful life. The use of the resources received is not restricted.

-

Repairs and Other Expenditures: Rundle Incorporated has various transactions in 20X6: a. Plant maintenance was done at a cost of $ 35,200. b. he entire manufacturing facility was repainted at a cost...

-

Franz's supervisor asked him to prepare Crane Corporation's year - end results for its gaming chairs under variable costing instead of under the absorption costing method it had used for years ( the...

-

8.1 Create a one-way data table for profit at different levels of supplier contact in range B22:C33. Ensure that the price in cell C3 is $290 and the advertising budget in cell C5 is $35,000,000 (you...

-

Julieta Simms is the president and sole shareholder of Simms Corporation (a cash method, calendar year C corporation), 1121 Madison Street, Seattle, WA 98121. Julieta plans for the corporation to...

-

In January 2022, Pelican, Inc., established an allowance for uncollectible accounts (bad debt reserve) of $70,000 on its books and increased the allowance by $120,000 during the year. As a result of...

-

Use Gauss's Method to find each. 2 -1 (a)(b) 3 0 2

-

Explain in simple terms the concept of: "Technology Structures and Social Boundaries"

-

1- According to the Six Steps in Strategic Planning find out the Lidl and Mercadona strategic plan 2021-2022 in Spain. Highlight the major differences and similarities between them. 2- Make a picture...

-

Your writing must present an introduction, development and conclusion. At the end of your work include the APA references. case 1: program for the agency that provides services to the government...

-

7. (8 points) In the following VHDL process, if input A changes at time 20nS and no other inputs change after that time, at what time will all the output signals be guaranteed to have assumed their...

-

Q1. Tenure analysis: Table: employee Column Name Data Type Description employee_id Integer Unique identifier for each employee department Varchar The department of the employee job_level Varchar The...

-

Rainbow Company purchased land, a building, and equipment on January 2, 2017, for $850,000. The company paid $170,000 cash and signed a mortgage note payable for the remainder. Management's best...

-

Data 9.2 on page 540 introduces the dataset Cereal, which includes information on the number of grams of fiber in a serving for 30 different breakfast cereals. The cereals come from three different...

-

Mary is a shareholder in CarrollCo, a calendar year S corporation. At the beginning of the year, her stock basis is $10,000, her share of the AAA is $2,000, and her share of corporate AEP is $6,000....

-

Mary is a shareholder in CarrollCo, a calendar year S corporation. At the beginning of the year, her stock basis is $10,000, her share of the AAA is $2,000, and her share of corporate AEP is $6,000....

-

Mary is a shareholder in CarrollCo, a calendar year S corporation. At the beginning of the year, her stock basis is $10,000, her share of the AAA is $2,000, and her share of corporate AEP is $6,000....

-

Series of Compound Interest Techniques The following are several situations involving compound interest. Required: Using the appropriate table, solve each of the following: ( Click here to access the...

-

If Clark Kelly has recognized gain on an exchange of like-kind property held for investment use, where does Clark report the gain? First on Form 8824, then carried to Schedule D. First on Form 8824,...

-

An investor put 40% of her money in Stock A and 60% in Stock B. Stock A has a beta of 1.2 and Stock B has a beta of 1.6. If the risk-free rate is 5% and the expected return on the market is 12%,...

Study smarter with the SolutionInn App