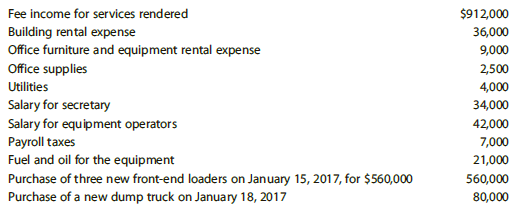

John Smith, age 31, is single and has no dependents. At the beginning of 2017, John started

Question:

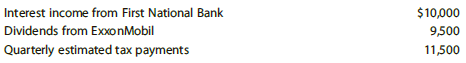

During 2017, John recorded the following additional items.

John makes the election under § 179 on the three front-end loaders purchased in January. John claims any available additional first-year depreciation.

On October 8, 2017, John inherited IBM stock from his Aunt Mildred. John had been her favorite nephew. According to the data provided by the executor of Aunt Mildred€™s estate, the stock was valued for estate tax purposes at $110,000. John is considering selling the IBM stock for $125,000 on December 29, 2017, and using $75,000 of the proceeds to purchase an Acura ZDX. He would use the car 100% for business. John wants to know what effect these transactions would have on his 2017 adjusted gross income.

Write a letter to John in which you present your calculations, and prepare a memo for the tax files. Ignore any Federal self-employment tax implications.

Step by Step Answer:

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young