Mario, a single taxpayer with two dependent children, has the following items of income and expense during

Question:

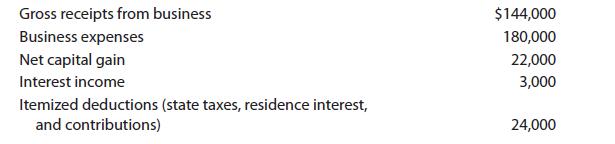

Mario, a single taxpayer with two dependent children, has the following items of income and expense during 2022:

a. Determine Mario’s taxable income for 2022.

b. Determine Mario’s NOL for 2022.

Transcribed Image Text:

Gross receipts from business Business expenses Net capital gain Interest income Itemized deductions (state taxes, residence interest, and contributions) $144,000 180,000 22,000 3,000 24,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 40% (5 reviews)

a b Business receipts Less Business expenses Net business l...View the full answer

Answered By

Tobias sifuna

I am an individual who possesses a unique set of skills and qualities that make me well-suited for content and academic writing. I have a strong writing ability, allowing me to communicate ideas and arguments in a clear, concise, and effective manner. My writing is backed by extensive research skills, enabling me to gather information from credible sources to support my arguments. I also have critical thinking skills, which allow me to analyze information, draw informed conclusions, and present my arguments in a logical and convincing manner. Additionally, I have an eye for detail and the ability to carefully proofread my work, ensuring that it is free of errors and that all sources are properly cited. Time management skills are another key strength that allow me to meet deadlines and prioritize tasks effectively. Communication skills, including the ability to collaborate with others, including editors, peer reviewers, and subject matter experts, are also important qualities that I have. I am also adaptable, capable of writing on a variety of topics and adjusting my writing style and tone to meet the needs of different audiences and projects. Lastly, I am driven by a passion for writing, which continually drives me to improve my skills and produce high-quality work.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

Mario, a single taxpayer with two dependent children, has the following items of income and expense during 2021: a. Determine Marios taxable income for 2021. b. Determine Marios NOL for 2021. Gross...

-

Mary, a single taxpayer with two dependent children, has the following items of income and expense during 2014: Gross receipts from business ............ $144,000 Business expenses ...................

-

Mary, a single taxpayer with two dependent children, has the following items of income and expense during 2017: Gross receipts from business ....................................... $144,000 Business...

-

Returning to the data set canadaemplmntdata from Problem 17.4, get a line chart of Accommodation jobs by subsetting by VECTOR = v81682. Problem 17.4 The file canadaemplmntdata contains quarterly...

-

What is the objective of a structured walkthrough?

-

Gemini Incorporated reported current assets of $15,000 and current liabilities of $12,000 on its December 31, 1996, balance sheet. After examining the financial records, the auditor discov ered that...

-

Describe two benefits of using an ensemble of classification models.

-

Big Bobs Burger Barn would like to graphically depict the interaction among its lunch-ordering customers and its three employees. Customers come into the restaurant and eat there, rather than drive...

-

SPKY has the capacity to produce 15,000 units per month while incurring the following costs: Direct material $3.00 S Direct labou $4.00 r $1.50 Variable manufacturing overhead Variable selling expens...

-

The figure shows a cantilever consisting of steel angles size 100 mm x 100 mm x 12 mm mounted back to back. Using superposition, find the deflection at 8 and the maximum stress in the beam. Take the...

-

During 2022, Rick and his wife, Sara, had the following items of income and expense to report: a. Assuming that Rick and Sara file a joint return, what is their taxable income for 2022? b. What is...

-

During 2022, Leisel, a single taxpayer, operates a sole proprietorship in which she materially participates. Her proprietorship generates gross income of $142,000 and deductions of $420,000,...

-

In Exercises 101108, simplify by reducing the index of the radical. /5

-

1) What are the benefits of home-based working for the company and the employees? 2) What are the challenges in performance management in working from home? 3) What is the right mix of office-based...

-

This assignment is focused on project selection and the underlying factors used to make this determination. You will need to use the readings/videos, the previous learning modules, along with some...

-

1. While improper framing could affect the information we have on sark attacks, I think our decisions come down to "anchoring and adjustment". Because the information we received from the media was...

-

For each of the scenarios in the following table, indicate the most likely reason for the difference in earnings. Scenario Differences in Human Capital Compensating Differential Differences in...

-

All organizations whether it is the government, a private business or small businessman require planning. To turn their dreams of increase in sale, earning high profit and getting success in business...

-

Specific financial decisions often depend more on one type of accounting information than another. Consider the following independent, hypothetical situations: 1. Samuel Colt owns a company called...

-

The sales department of P. Gillen Manufacturing Company has forecast sales in March to be 20,000 units. Additional information follows: Finished goods inventory, March 1 . . . . . . . . . . . . . . ....

-

Ivanna, who has three children under age 13, worked full-time while her spouse, Sergio, was attending college for nine months during the year. Ivanna earned $28,000 and incurred $9,100 of child care...

-

Ivanna, who has three children under age 13, worked full-time while her spouse, Sergio, was attending college for nine months during the year. Ivanna earned $28,000 and incurred $9,100 of child care...

-

Ivanna, who has three children under age 13, worked full-time while her spouse, Sergio, was attending college for nine months during the year. Ivanna earned $28,000 and incurred $9,100 of child care...

-

(15 points) Stressed $2.500,000 of S% 20 year bands. These bonds were issued Jary 1, 2017 and pay interest annually on each January 1. The bonds yield 3% and was issued at $325 8S! Required (2)...

-

Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for...

-

1. A company issued 10%, 10-year bonds with a par value of $1,000,000 on January 1, at a selling price of $885,295 when the annual market interest rate was 12%. The company uses the effective...

Study smarter with the SolutionInn App