On June 1, 2018, Skylark Enterprises, a calendar year LLC reporting as a sole proprietorship, acquired a

Question:

On June 1, 2018, Skylark Enterprises, a calendar year LLC reporting as a sole proprietorship, acquired a retail store building for $500,000 (with $100,000 being allocated to the land). The store building was 39-year real property, and the straight-line cost recovery method was used. The property was sold on June 21, 2022, for $385,000.

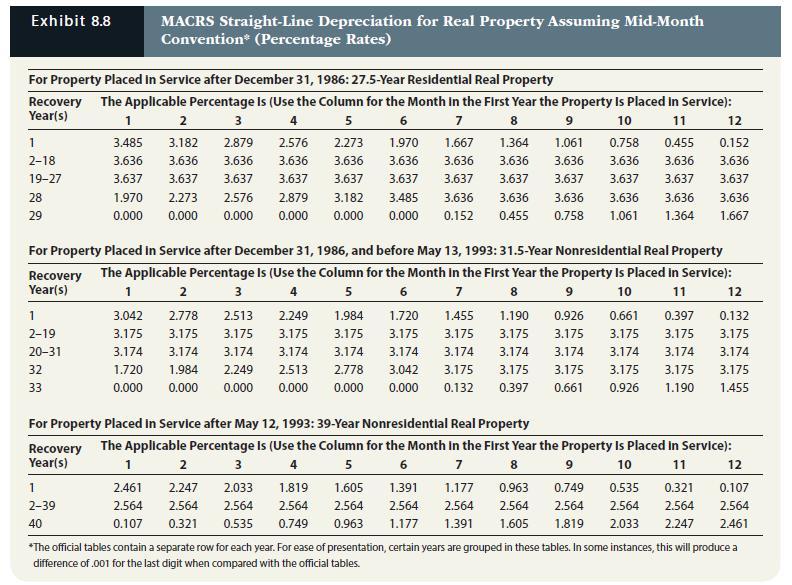

a. Compute the cost recovery and adjusted basis for the building using Exhibit 8.8 from Chapter 8.

b. What are the amount and nature of Skylark’s gain or loss from disposition of the property? What amount, if any, of the gain is unrecaptured § 1250 gain?

Transcribed Image Text:

Exhibit 8.8 For Property Placed in Service after December 31, 1986: 27.5-Year Residential Real Property Recovery The Applicable Percentage Is (Use the Column for the Month in the First Year the Property is placed in Service): Year(s) 1 2 3 4 5 6 7 8 10 11 3.485 3.182 2.879 2.576 2.273 1.970 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 3.637 3.637 3.637 1.970 2.273 2.576 2.879 3.182 0.000 0.000 0.000 0.000 0.000 1 2-18 19-27 28 29 1 2-19 20-31 32 33 MACRS Straight-Line Depreciation for Real Property Assuming Mid-Month Convention* (Percentage Rates) For Property Placed in Service after December 31, 1986, and before May 13, 1993: 31.5-Year Nonresidential Real Property Recovery The Applicable Percentage Is (Use the Column for the Month in the First Year the Property Is Placed in Service): Year(s) 3 4 5 6 7 8 9 10 11 1.190 0.926 3.175 3.175 3.174 3.175 3.175 3.175 3.175 0.661 0.926 1.190 1.455 0.397 1 2-39 40 1 2 1.984 3.175 3.042 2.778 2.513 2.249 3.175 3.175 3.175 3.175 3.174 3.174 3.174 3.174 3.174 1.720 1.984 2.249 2.513 2.778 0.000 0.000 0.000 0.000 0.000 2.461 2.564 0.107 9 1.667 1.364 1.061 0.758 3.636 3.636 3.636 3.636 3.637 3.637 3.637 3.636 3.636 3.636 3.636 0.000 0.152 0.455 0.758 1.061 1.364 1.667 3.637 3.485 3.636 3.636 2 2.247 2.564 0.321 0.535 1.720 1.455 3.175 3.175 3.174 3.174 3.174 3.042 3.175 0.000 0.132 0.455 3.636 3.637 0.661 3.175 3.174 12 0.152 3.636 3.637 For Property Placed in Service after May 12, 1993: 39-Year Nonresidential Real Property Recovery The Applicable Percentage Is (Use the Column for the Month in the First Year the Property Is Placed in Service): Year(s) 3 4 5 6 7 8 10 11 2.033 1.819 2.564 2.564 0.749 12 0.397 0.132 3.175 3.175 3.174 3.174 3.175 9 1.605 0.963 0.749 0.535 0.321 1.391 1.177 2.564 2.564 2.564 2.564 2.564 2.564 2.564 0.963 1.177 1.391 1.605 1.819 2.033 2.247 12 0.107 2.564 2,461 *The official tables contain a separate row for each year. For ease of presentation, certain years are grouped in these tables. In some instances, this will produce a difference of .001 for the last digit when compared with the official tables.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

a b Building cost 2018 cost recovery rate 2019 cost recove...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

On June 1, 2017, Skylark Enterprises (a calendar year LLC reporting as a sole prorietorship) acquired a retail store building for $500,000 (with $100,000 being allocated to the land). The store...

-

On June 1, 2010, Skylark Enterprises (not a corporation) acquired a retail store building for $500,000 (with $100,000 being allocated to the land). The store building was 39-year real property, and...

-

On June 1, 2012, Skylark Enterprises (not a corporation) acquired a retail store building for $500,000 (with $100,000 being allocated to the land). The store building was 39-year real property, and...

-

To meet the demand for parking, your town has allocated the area shown here. As the town engineer, you have been asked by the town council to find out if the lot can be built for $11,000. The cost to...

-

What is referential integrity? Describe how it is enforced when a new foreign key value is created, when a row containing a primary key is deleted, and when a primary key value is changed.

-

McCartney Manufacturing purchased a dryer for $100,000 on January 1, 1993. The estimated life of the dryer is five years, and the salvage value is estimated to be $10,000. McCartney uses (Accounting...

-

Does charting help investors? Some investors believe that charts of past trends in the prices of securities can help predict future prices. Most economists disagree. In an experiment to examine the...

-

Venture Camps, Inc., leases the land on which it builds camp sites. Venture is considering opening a new site on land that requires $2,500 of rental payment per month. The variable cost of providing...

-

Christopher Crosphit (birthdate April 28, 1978) owns and operates a health club called "Catawba Fitness". The business is located at 4321 New Cut Road, Spartanburg, SC 29303. The principal business...

-

An investment bank has the following customers. Investor A Long forward contract to buy 1000 ounces of gold at HK$10000 per ounce in 3 months Investor B Short European put options to sell 500 ounces...

-

Copper Industries (a sole proprietorship) sold three 1231 assets during 2022. Data on these property dispositions are as follows: a. Determine the amount and the character of the recognized gain or...

-

For 2022, Wilma has properly determined taxable income of $36,000, including $3,000 of unrecaptured 1250 gain and $8,200 of 0%/15%/20% gain. Wilma qualifies for head-of-household filing status....

-

Insert the missing word: The point is that success in business and the public sector is intimately tied into the act of risk taking. Risk arises from . . . . . . . . . . . . . . . . . . . . . . . . ....

-

The file NFL2012data.xlsx contains scores of all the NFL 2012 regular-season games. Rate the teams. Even though the Colts were 106, your ratings have the Colts as well below the average team. Can you...

-

A certain company reorders envelopes when its stock drops to 12 boxes, although demand for envelopes during lead time is normally distributed with a mean of 10 boxes and a standard deviation of 3...

-

Indicate the uses of budgeting and construct various budgets, including the cash budget, from relevant data.

-

Complete the double entry for each of the following transactions: a The owner of a business pays additional capital to the company; the cash account is debited and it is credited to the __________. b...

-

The file named Worldball.xlsx contains all the scores from the 2006 World Basketball Championships. Rate the teams. Who were the best three teams?

-

The records of Khanna Company show the following amounts in its December 31 financial statements: Khanna made the following errors in determining its ending inventory : 1. The ending inventory...

-

A condenser (heat exchanger) brings 1 kg/s water flow at 10 kPa quality 95% to saturated liquid at 10 kPa, as shown in Fig. P4.91. The cooling is done by lake water at 20C that returns to the lake at...

-

Using PowerPoint slides, list at least three of the Statements on Standards for Tax Services that apply to CPAs. For each standard you choose, provide a short explanation of its content.

-

Using PowerPoint slides, list at least three of the Statements on Standards for Tax Services that apply to CPAs. For each standard you choose, provide a short explanation of its content.

-

Alexi files her tax return 20 days after the due date. Along with the return, she remits a check for $3,000, which is the balance of the tax she owes. Disregarding any interest liabilities, compute...

-

Ventaz Corp manufactures small windows for back yard sheds. Historically, its demand has ranged from 30 to 50 windows per day with an average of 4646. Alex is one of the production workers and he...

-

Which of the following statements is not true regarding the $500 credit for dependent other than a qualifying child credit. Cannot be claimed on the same tax return if the child tax credit is also...

-

Grind Co. is considering replacing an existing machine. The new machine is expected to reduce labor costs by $127,000 per year for 5 years. Depreciation on the new machine is $57,000 compared with...

Study smarter with the SolutionInn App