Wally, Inc., sold the following three personal property assets in year 6: What is Wallys net Section

Question:

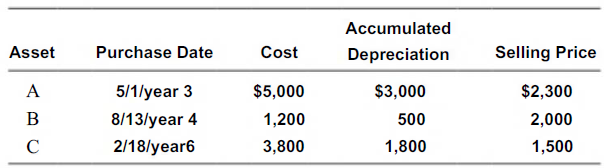

Wally, Inc., sold the following three personal property assets in year 6:

What is Wally’s net Section 1231 gain or loss in year 6?

a. $500 loss

b. $300 gain

c. $800 gain

d. $1,600 gain

Transcribed Image Text:

Accumulated Depreciation Purchase Date Selling Price Asset Cost 5/1/year 3 8/13/year 4 A $5,000 1,200 3,800 $3,000 $2,300 500 2,000 1,500 2/18/year6 1,800

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 90% (10 reviews)

c ...View the full answer

Answered By

Douglas Makokha

Unlock Academic Success with Dedicated Tutoring and Expert Writing Support!

Are you ready to excel in your academics? Look no further! As a passionate tutor, I believe that dedication and hard work are the keys to achieving outstanding results. When it comes to academics, I strive to provide nothing but the best for every student I encounter.

With a relentless thirst for knowledge, I have extensively researched numerous subjects and topics, equipping myself with a treasure trove of answers to tackle any question that comes my way. With four years of invaluable experience, I have mastered the art of unraveling even the most intricate problems. Collaborating with esteemed writers has granted me exclusive access to the trade secrets utilized by the industry's top professionals.

Allow me the pleasure of assisting you with your writing assignments. I thrive on challenges and will guide you through any obstacles you may face. Together, we will unlock your academic potential and pave the way for your success.

4.90+

62+ Reviews

349+ Question Solved

Related Book For

South-Western Federal Taxation 2019 Comprehensive

ISBN: 9781337703017

42th Edition

Authors: David M. Maloney, William A. Raabe, William H. Hoffman, James C. Young

Question Posted:

Students also viewed these Business questions

-

Bostian Company reports a net Section 1231 gain of $31,000 during the current year. Identify the tax issue(s) posed by the facts presented. Determine the possible tax consequences of each issue that...

-

1. What is Alexander's net gain or loss on the liquidation of his 100 percent interest in an S corporation if the corporation distributes the following three assets to him in exchange for his stock:...

-

What type of assets are Section 1231 assets? What type of assets are capital assets? What type of assets are ordinary income assets? Give several examples of each type of asset.

-

A particular leadcadmium alloy is 8.0% cadmium by mass. What mass of this alloy, in grams, must you weigh out to obtain a sample containing 7.25 x 10 23 Cd atoms?

-

Give an example of a poset with four maximal elements but no greatest element.

-

Find the angle between the vectors (a) In radians (b) In degrees u = (1, 1, 1) v = (2, 1, 1)

-

Despite its name, prime rib does not have to come from prime grade beef. Contact your local butcher or meat purveyor to identify exactly which ribs are contained in prime rib. Check this...

-

Crystal Clear Cleaning has decided that, in addition to providing cleaning services, it will sell cleaning products. Crystal Clear uses the perpetual inventory system. During December 2018, Crystal...

-

On April 1 , $ 2 5 , 0 0 0 . 0 0 3 6 4 - day treasury bills were auctioned off to yield 3 . 1 1 % . ( a ) What is the price of each $ 2 5 , 0 0 0 . 0 0 T - bill on April 1 ? ( b ) What is the yield...

-

From the tenth floor of her office building, Katherine Rally watches the swarms of New Yorkers fight their way through the streets infested with yellow cabs and the sidewalks littered with hot dog...

-

Wally, Inc., sold the following three personal property assets in year 6: What is Wally's net Section 1231 gain or loss in year 6? a. $500 loss b. $700 loss c. $1,200 loss d. $ 1,200 gain Accumulated...

-

Wally, Inc., sold the following three personal property assets in year 6: What is Wally's Section 1245 recapture in year 6? a. $500 loss b. $300 gain c. $800 gain d. $1,600 gain Accumulated Purchase...

-

A company operating three factories that use different types of production is interested in the number of defective products produced. The following table gives the results of a sampling study done...

-

Pink Jeep Tours offers off-road tours to individuals and groups visiting the Southwestern U.S. hotspots of Sedona, Arizona, and Las Vegas, Nevada. Take a tour of the companys Web site at...

-

The following are unrelated accounting practices: 1. Pine Company purchased a new \(\$ 30\) snow shovel that is expected to last six years. The shovel is used to clear the firm's front steps during...

-

Identify whether the following statements are true or false. 1. One argument for IFRS is that there is less globalization in the world. 2. IFRS is accepted as GAAP in every country of the world. 3....

-

You will need isometric dot paper for this question. Part of a pattern using four rhombuses is drawn on isometric dot paper below. By drawing two more rhombuses, complete the pattern so that it has a...

-

Fred Flores operates a golf driving range. For each of the following financial items related to his business, indicate the financial statement (or statements) in which the item would be reported:...

-

In Exercises use graphs and tables to find (a) lim x (x) and (b) lim x - (x) (c) Identify all horizontal asymptotes. - f(x) = e X

-

Factor and simplify, if possible. Check your result using a graphing calculator. 3 cot 2 + 6 cot + 3

-

Willa, a U.S. corporation, owns the rights to a patent related to a medical device. Willa licenses the rights to use the patent to IrishCo, which uses the patent in its manufacturing facility located...

-

Willa, a U.S. corporation, owns the rights to a patent related to a medical device. Willa licenses the rights to use the patent to IrishCo, which uses the patent in its manufacturing facility located...

-

Willa, a U.S. corporation, owns the rights to a patent related to a medical device. Willa licenses the rights to use the patent to IrishCo, which uses the patent in its manufacturing facility located...

-

QUESTION 3 A business owns seven flats rented out to staff at R500 per month. All flats were tenanted Ist january 21 months rent was in arrears and as at 31st December 14 months' rent wa Identify the...

-

1. 2. 3. Select the Tables sheet, select cells A6:B10, and create range names using the Create from Selection button [Formulas tab, Defined Names group]. Select cells B1:F2 and click the Name box....

-

Tropical Rainwear issues 3,000 shares of its $18 par value preferred stock for cash at $20 per share. Record the issuance of the preferred shares. (If no entry is required for a particular...

Study smarter with the SolutionInn App