Wally, Inc., sold the following three personal property assets in year 6: What is Wally's Section 1245

Question:

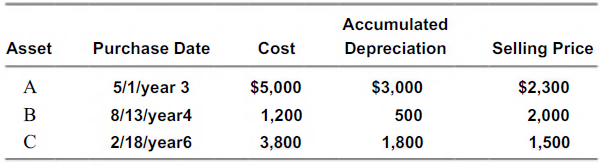

Wally, Inc., sold the following three personal property assets in year 6:

What is Wally's Section 1245 recapture in year 6?

a. $500 loss

b. $300 gain

c. $800 gain

d. $1,600 gain

Transcribed Image Text:

Accumulated Purchase Date Selling Price Asset Cost Depreciation 5/1/year 3 A $5,000 $3,000 $2,300 B 1,200 8/13/year4 500 2,000 1,800 1,500 2/18/year6 3,800

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (14 reviews)

c ...View the full answer

Answered By

Rinki Devi

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions.

Hi there! Are you looking for a committed, reliable, and enthusiastic tutor? Well, teaching and learning are more of a second nature to me, having been raised by parents who are both teachers. I have done plenty of studying and lots of learning on many exciting and challenging topics. All these experiences have influenced my decision to take on the teaching role in various capacities. As a tutor, I am looking forward to getting to understand your needs and helping you achieve your academic goals. I'm highly flexible and contactable. I am available to work on short notice since I only prefer to work with very small and select groups of students.

I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and helped them achieve great subject knowledge.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2019 Comprehensive

ISBN: 9781337703017

42th Edition

Authors: David M. Maloney, William A. Raabe, William H. Hoffman, James C. Young

Question Posted:

Students also viewed these Business questions

-

Section 1245 recapture applies to which of the following? a. Section 1231 real property sold at a gain with accumulated depreciation in excess of straight line. b. Section 1231 personal property sold...

-

Robert is the sole shareholder and CEO of ABC, Inc., an S corporation that is a qualified trade or business. During the current year, ABC records net income of $325,000 after deducting Roberts...

-

Assume the same facts as in Problem 35, except that the business is a specified services" business (e.g., a consulting firm) owned equally by Elliot and Conrad (an unrelated individual) in a...

-

A mover lifts a 50 lbm box off the ground and places it on a truck (Figure 1-21). If the floor of the truck is 4 feet off the ground, how much work was required to lift the box? 4 ft 50 lbs...

-

Draw the Hasse diagram for the poset (P(U), ), where U = {1, 2, 3, 4}.

-

Find u v and show that it is orthogonal to both u and v. u = (12, -3,0) V v = (-2, 5, 0)

-

Collect two takeout menus from restaurants near your home. Identify by circling the menu items, any reference to preparation style, brand - name ingredients, origin, size, or health benefit of their...

-

The statements of comprehensive income for Highway plc, Road Ltd and Lane Ltd for the year ended 31 December 20X9 were as follows: Highway plc acquired 80% of Road Ltd for $160,000 on 1.1.20X6 when...

-

Required Information Use the following Information for the Exercises below. [The following information applies to the questions displayed below.] Hart Company made 4,500 bookshelves using 21,000...

-

The database Airfares.xlsx contains information on the air- fare on 638 routes in the United States. In addition, it contains data on the length of the route, the average income in the starting and...

-

Wally, Inc., sold the following three personal property assets in year 6: What is Wallys net Section 1231 gain or loss in year 6? a. $500 loss b. $300 gain c. $800 gain d. $1,600 gain Accumulated...

-

Net Section 1231 losses are: a. Deducted as a capital loss against other capital gains and nothing against ordinary income b. Deducted as a capital loss against other capital gains and up to $3,000...

-

"Because cross-tabulation has certain basic limitations, this technique should not be used extensively in commercial marketing research." Discuss as a small group.

-

Sketch plane / intersecting plane K. Then draw a line & in plane J that intersects plane Kat a single point. A X C B D E

-

Use a graphing utility to verify any five of the graphs that you drew by hand in Exercises 126. Data from exercise 1-26 1. x + 2y = 8 3. x2y> 10 2. 3x6y 12 4. 2xy > 4

-

The following information pertains to Porter Company for 2011. Ending inventory consisted of 30 units. Porter sold 320 units at \(\$ 30\) each. All purchases and sales were made with cash. Required...

-

In Problems 7780, use a numerical integration routine on a graphing calculator to find the area bounded by the graphs of the indicated equations over the given interval (when stated). Compute answers...

-

Solar Heating, Inc., had the following transactions for 2011: Required a. Determine the quantity and dollar amount of inventory at the end of the year, assuming Solar Heating Inc. uses the FIFO cost...

-

In Exercises find (2). f(x) = sin 7- 2

-

Perform the indicated operations. In designing a cam for a fire engine pump, the expression is used. Simplify this expression. (3) (3 4 32

-

Sandstorm Corporation decides to develop a new line of paints. The project begins in 2021. Sandstorm incurs the following expenses in 2021 in connection with the project: Salaries...

-

Ella and Emma are twin sisters who live in Louisiana and Mississippi, respectively. Ella is married to Frank, and Emma is married to Richard. Frank and Richard are killed in an auto accident in 2021...

-

Liam owns a personal use boat that has a fair market value of $35,000 and an adjusted basis of $45,000. Liams AGI is $100,000. Calculate the realized and recognized gain or loss if: a. Liam sells the...

-

XF Ltd. Is an expanding private company in the electric trade. Accounts preparing in January 2019 included the following information: Profit Statement for the year ended 31 st December 2018 Kshs.000...

-

Check On June 15, 2021, Sanderson Construction entered into a long-term construction contract to build a baseball stadium in Washington D.C., for $340 million. The expected completion date is April...

-

Q.1 Bassem Company purchased OMR420,000 in merchandise on account during the month of April, and merchandise costing OMR $350,000 was sold on account for OMR 425,000. Required: 1. Prepare journal...

Study smarter with the SolutionInn App