Wally, Inc., sold the following three personal property assets in year 6: What is Wally's net Section

Question:

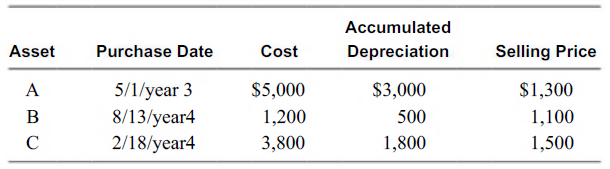

Wally, Inc., sold the following three personal property assets in year 6:

What is Wally's net Section 1231 gain or loss in year 6?

a. $500 loss

b. $700 loss

c. $1,200 loss

d. $ 1,200 gain

Transcribed Image Text:

Accumulated Depreciation Purchase Date Cost Asset Selling Price $1,300 5/1/year 3 $5,000 $3,000 A 8/13/year4 2/18/year4 1,200 B 500 1,100 3,800 1,800 1,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

c ...View the full answer

Answered By

Nazrin Ziad

I am a post graduate in Zoology with specialization in Entomology.I also have a Bachelor degree in Education.I posess more than 10 years of teaching as well as tutoring experience.I have done a project on histopathological analysis on alcohol treated liver of Albino Mice.

I can deal with every field under Biology from basic to advanced level.I can also guide you for your project works related to biological subjects other than tutoring.You can also seek my help for cracking competitive exams with biology as one of the subjects.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2019 Comprehensive

ISBN: 9781337703017

42th Edition

Authors: David M. Maloney, William A. Raabe, William H. Hoffman, James C. Young

Question Posted:

Students also viewed these Business questions

-

Bostian Company reports a net Section 1231 gain of $31,000 during the current year. Identify the tax issue(s) posed by the facts presented. Determine the possible tax consequences of each issue that...

-

1. What is Alexander's net gain or loss on the liquidation of his 100 percent interest in an S corporation if the corporation distributes the following three assets to him in exchange for his stock:...

-

What type of assets are Section 1231 assets? What type of assets are capital assets? What type of assets are ordinary income assets? Give several examples of each type of asset.

-

From the densities of the lines in the mass spectrum of krypton gas, the following observations were made: Somewhat more than 50% of the atoms were krypton-84. The numbers of krypton-82 and...

-

If (A, R) is a poset but not a total order, and B A, does it follow that (B B) R makes B into a poset but not a total order?

-

Find the angle between the vectors (a) In radians (b) In degrees u = 3i + 2j + k v = 2i - 3j

-

As a drug, alcohol is classified as a depressant. Consult a medical encyclopedia to identify at least two other types of depressants, as well as the following characteristics of depressants: Their...

-

Match the selected sections of IASB-proposed statement of financial position (letters) with their respective components (numbers). a. Short-term assets b. Long-term assets c. Short-term liabilities...

-

During 2019 Searing, Inc. Made fourteen wells drills for oil with total costs of $42,000,000. The results of the drilling are, eight wells are successful, and the remaining wells are unsuccessful...

-

Use discriminant analysis to classify the new data in the Excel file Credit Approval Decisions Coded using only credit score and years of credit history as input variables.

-

Wally, Inc., sold the following three personal property assets in year 6: What is Wally's net Section 1231 gain or loss in year 6? a. $500 loss b. $300 gain c. $800 gain d. $ 1,600 gain Accumulated...

-

Wally, Inc., sold the following three personal property assets in year 6: What is Wallys net Section 1231 gain or loss in year 6? a. $500 loss b. $300 gain c. $800 gain d. $1,600 gain Accumulated...

-

Identify the main features of the process of perception. 202-3

-

The following post-closing trial balance was drawn from the accounts of Spruce Timber Co. as of December 31, 2011. Transactions for 2012 1. Acquired an additional \(\$ 10,000\) cash from the issue of...

-

Bankers Trust (BT) was one of the most powerful and profitable banks in the world in the early 1990s. Under the stewardship of chairman Charles Sanford Jr., it had transformed itself from a staid...

-

Hammond Inc. experienced the following transactions for 2011, its first year of operations: 1. Issued common stock for \(\$ 80,000\) cash. CHECK FIGURES b. Net Income: \(\$ 62,520\) Total Assets:...

-

Following are the current prices and last years prices of a gallon of regular gas at a sample of 14 gas stations. Can you conclude that the median price is different now from what it was a year ago?...

-

A sample of nine men participated in a regular exercise program at a local gym. They were weighed both before and after the program. The results were as follows. Can you conclude that the median...

-

In Exercises find the average rate of change of the function over each interval. (x) = e x (a) [- 2, 0] (b) [1, 3]

-

In Exercises evaluate the limit, using LHpitals Rule if necessary. lim 07x cos x X

-

Chock, a U.S. corporation, purchases inventory for resale from distributors within the United States and resells this inventory at a $1 million profit to customers outside the United States. Title to...

-

Chock, a U.S. corporation, purchases inventory for resale from distributors within the United States and resells this inventory at a $1 million profit to customers outside the United States. Title to...

-

Chock, a U.S. corporation, purchases inventory for resale from distributors within the United States and resells this inventory at a $1 million profit to customers outside the United States. Title to...

-

Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments --Molding and Fabrication. It started, completed, and...

-

Horizontal Analysis The comparative accounts payable and long-term debt balances of a company are provided below. Current Year Previous Year Accounts payable $47,286 $63,900 Long-term debt 85,492...

-

On January 1, Year 1, Price Company issued $140,000 of five-year, 7 percent bonds at 97. Interest is payable annually on December 31. The discount is amortized using the straight-line method. Record...

Study smarter with the SolutionInn App