Wesley, who is single, listed his personal residence with a real estate agent on March 3, 2017,

Question:

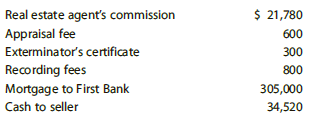

Wesley€™s adjusted basis for the house is $200,000. He owned and occupied the house for seven years. On October 1, 2017, Wesley purchases another residence for $325,000.

a. Calculate Wesley€™s recognized gain on the sale.

b. What is Wesley€™s adjusted basis for the new residence?

c. Assume instead that the selling price is $800,000. What is Wesley€™s recognized gain? His adjusted basis for the new residence?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young

Question Posted: