Based on the facts and results of Problems 38-43, calculate Kantner's total provision for income tax expense

Question:

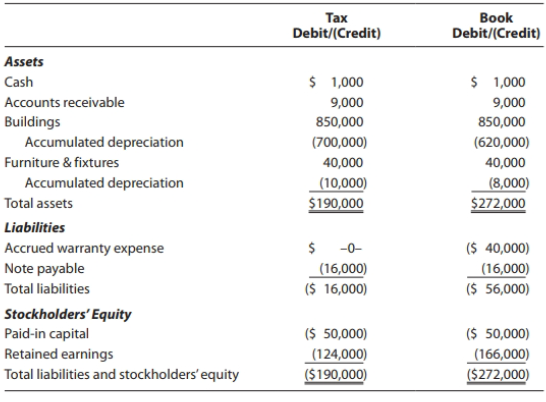

Based on the facts and results of Problems 38-43, calculate Kantner's total provision for income tax expense reported on its financial statement and its book net income after tax.

Data from 38

Transcribed Image Text:

Тах Book Debit/(Credit) Debit/(Credit) Assets $ 1,000 $ 1,000 Cash Accounts receivable 9,000 9,000 Buildings Accumulated depreciation 850,000 850,000 (620,000) (700,000) Furniture & fixtures 40,000 40,000 Accumulated depreciation |(10,000) $190,000 (8,000) $272,000 Total assets Liabilities ($ 40,000) Accrued warranty expense -0- Note payable |(16,000) (16,000) ($ 56,000) ($ 16,000) Total liabilities Stockholders' Equity Paid-in capital ($ 50,000) (166,000) ($272,000) ($ 50,000) (124,000) ($190,000) Retained earnings Total liabilities and stockholders' equity

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (10 reviews)

Book net income before tax 50000 Provis...View the full answer

Answered By

Sandhya Sharma

I hold M.Sc and M.Phil degrees in mathematics from CCS University, India and also have a MS degree in information management from Asian institute of technology, Bangkok, Thailand. I have worked at a international school in Bangkok as a IT teacher. Presently, I am working from home as a online Math/Statistics tutor. I have more than 10 years of online tutoring experience. My students have always excelled in their studies.

4.90+

119+ Reviews

214+ Question Solved

Related Book For

South Western Federal Taxation 2018 Essentials Of Taxation Individuals And Business Entities

ISBN: 9781337386173

21st Edition

Authors: William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

Question Posted:

Students also viewed these Business questions

-

During 2018, John was the chief executive officer and a shareholder of Maze, Inc. He owned 60% of the outstanding stock of Maze. In 2015, John and Maze, as co-borrowers, obtained a $100,000 loan from...

-

Roy decides to buy a personal residence, and he goes to the bank for a $150,000 loan. The bank tells Roy that he can borrow the funds at 4% if his father will guarantee the debt. Roy's father, Hal,...

-

Below are the results of a Dutch auction for an IPO of Bagels Bagels, a trendy bagel and coffee shop chain. Bagels is offering 50 million shares. a. What will be the clearing price? b. How many...

-

Lopez Company uses a job order cost accounting system that charges overhead to jobs on the basis of direct material cost. At year-end, the Goods in Process Inventory account shows the following. 1....

-

In each case, find all [a b c d]T m R4 such that the given set is orthogonal. (a) {[1 2 1 O]T, [1 -1 1 3]T, [2 -1 0 -1], [a b c d]T} (b) {[1 0 - 1]T, [2 1 1]T,[l -3 1 0]T, [a b c d}T}

-

Determine the values of x for which represents a real number. 9-x- zx^

-

Which of the following is not a best practice that can help in avoiding scope problems on IT projects? a. Keep the scope realistic. b. Use off-the-shelf hardware and software whenever possible. c....

-

Sterling Forest Landscaping designs and installs landscaping. The landscape designers and office staff use office supplies, while field supplies (rock, bark, etc.) are used in the actual landscaping....

-

Waterway Company follows the practice of pricing its inventory at LCNRV , on an individual - item basis. Item No . Quantity Cost per Unit Estimated Selling Price Cost to Complete and Sell 1 3 2 0 1 ,...

-

Purse Corporation owns 70 percent of Scarf Companys voting shares. On January 1, 20X3, Scarf sold bonds with a par value of $600,000 at 98. Purse purchased $400,000 par value of the bonds; the...

-

Provide the journal entry to record Kantner's current tax expense as determined in Problem 42. Data from 42 Kantner reported two permanent book-tax differences. It earned $7,800 in tax-exempt...

-

KellerCo reports $5 million of U.S. taxable income, the same as its book income, as there are no temporary book-tax differences this year. KellerCo is subject to a 21% Federal income tax rate. Its...

-

Line A: y = 1.5 + 0.5x, Line B: y = 1.125 + 0.375x Data points: In each of Exercise, we have presented two linear equations and a set of data points. For each exercise, a. Plot the data points and...

-

Outlines help in several ways: They help organize your thoughts so your speech is easy to follow. They keep you on track so you don't research beyond the scope of your speech. They give you a clear...

-

As a nurse leader you have to be able to have the willingness to be in a place of flexibility for change. Sometimes change can cause stress that can cloud our thoughts and ability to connect. Share a...

-

find T(625). I Given the recurrence relation T(n)=7T (n/5)+ 10n for n > 1 T (1)=1 Answer: (please write your answer here, add required space if needed)

-

2. (10 pts) The following program has many compilation errors. Underline each of the compilation errors, then rewrite each statement (even the correct ones) so that all these errors are fixed. Do not...

-

In this problem you will implement a variant of the List ADT. In particular you will implement the String-List ADT, in a concrete class called SListArray, based on the provided abstract Slist class....

-

For the following exercises, find the domain, vertical asymptotes, and horizontal asymptotes of the functions. f(x) = x 4 9-x

-

Cleaning Service Company's Trial Balance on December 31, 2020 is as follows: Account name Debit Credit Cash 700 Supplies Pre-paid insurance Pre-paid office rent Equipment Accumulated depreciation -...

-

P Ltd is the parent company of a small group. All companies in the group are UK resident and all of the issued shares of each company are ordinary shares. Shareholdings within the group are as...

-

P Ltd is the parent company of a small group. All companies in the group are UK resident and all of the issued shares of each company are ordinary shares. Shareholdings within the group are as...

-

The ordinary share capital of PP Ltd (a trading company) is owned 32% by QQ Ltd, 35% by RR Ltd, 23% by SS Ltd. The remaining 10% is owned by various individuals, none of whom own more than 1%. All...

-

On April 1, year 1, Mary borrowed $200,000 to refinance the original mortgage on her principal residence. Mary paid 3 points to reduce her interest rate from 6 percent to 5 percent. The loan is for a...

-

Give a numerical example of: A) Current liabilities. B) Long-term liabilities?

-

Question Wonder Works Pte Ltd ( ' WW ' ) produces ceramic hair curlers to sell to department stores. The production equipment costs WW $ 7 0 , 0 0 0 four years ago. Currently, the net book value...

Study smarter with the SolutionInn App