Question: Consider the monthly simple excess returns of Pfizer stock and the S&P 500 composite index from January 1990 to December 2003. The excess returns are

Consider the monthly simple excess returns of Pfizer stock and the S&P 500 composite index from January 1990 to December 2003. The excess returns are in m-pfesp-ex9003.txt with Pfizer stock returns in the first column.

(a) Fit a fixed-coefficient market model to the Pfizer stock return. Write down the fitted model.

(b) Fit a time-varying CAPM to the Pfizer stock return. What are the estimated standard errors of the innovations to the \(\alpha_{t}\) and \(\beta_{t}\) series? Obtain time plots of the smoothed estimates of \(\alpha_{t}\) and \(\beta_{t}\).

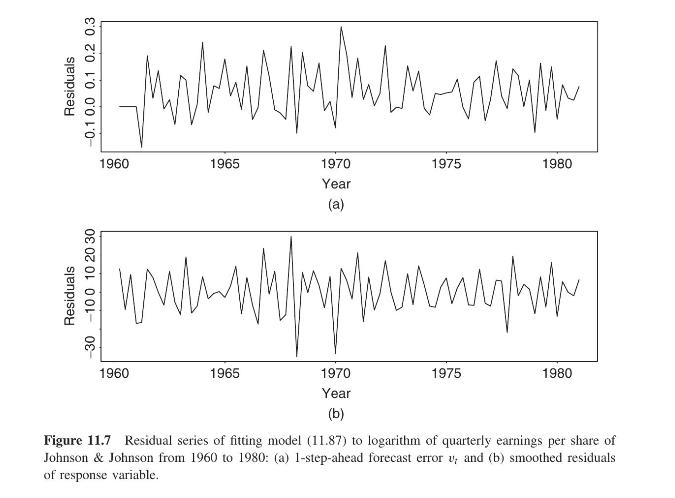

-30 Residuals -100 10 20 30 1960 1965 1970 1975 1980 Year (a) 1960 1965 1970 Year 1975 1980 (b) Figure 11.7 Residual series of fitting model (11.87) to logarithm of quarterly earnings per share of Johnson & Johnson from 1960 to 1980: (a) 1-step-ahead forecast error v, and (b) smoothed residuals of response variable.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts