Peter Campbell plans to invest in real estate income property. He plans to hold that property for

Question:

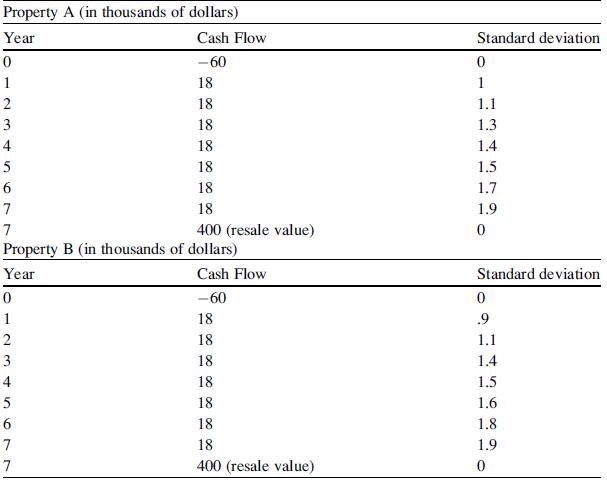

Peter Campbell plans to invest in real estate income property. He plans to hold that property for 7 years. He is considering two income properties, A and B.

Their initial investment, cash flows, standard deviations of cash flows, and resale values are as follows.

Use Microsoft Excel to calculate the NPV and σNPV of each property. (Assume a discount rate of 12 %.)According to the results, which property should Peter choose?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Statistics For Business And Financial Economics

ISBN: 9781461458975

3rd Edition

Authors: Cheng Few Lee , John C Lee , Alice C Lee

Question Posted: