Big Sky Inc. recorded the following transactions over the life of a piece of equipment purchased in

Question:

Big Sky Inc. recorded the following transactions over the life of a piece of equipment purchased in 2005:

Jan. 1, 2005: Purchased the equipment for \($36,000\) cash. The equipment is estimated to have a five- year life and \($6,000\) salvage value and was to be depreciated using the straight-line method.

Dec. 31, 2005: Recorded depreciation expense for 2005.

May 5, 2006: Undertook routine repairs costing \($750\) .

Dec. 31, 2006: Recorded depreciation expense for 2006.

Jan. 1, 2007: Made an adjustment costing \($3,000\) to the equipment. It improved the quality of the output but did not affect the life estimate.

Dec. 31, 2007: Recorded depreciation expense for 2007. Incurred \($320\) cost to oil and clean the equipment.

Mar. 1, 2008: Incurred \($320\) cost to oil and clean the equipment.

Dec. 31, 2008: Recorded depreciation expense for 2008.

Jan. 1, 2009: Had the equipment completely overhauled at a cost of \($7,500\) . The overhaul was estimated to extend the total life to seven years and revised the salvage value to \($4,000\) .

Dec. 31, 2009: Recorded depreciation expense for 2009.

July 1, 2010: Sold the equipment for \($9,000\) cash.

Required:

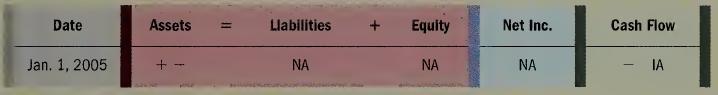

a. Use a horizontal statements model like the following one to show the effects of these transactions on the elements of the financial statements. Use + for increase, — for decrease, and NA for not affected. The first event is recorded as an example.

b. Determine amount of depreciation expense Big Sky will report on the income statements for the years 2005 through 2009.

c. Determine the book value (cost — accumulated depreciation) Big Sky will report on the balance sheets at the end of the years 2005 through 2009.

d. Determine the amount of the gain or loss Big Sky will report on the disposal of the equipment on July 1,2010.

Step by Step Answer:

Survey Of Accounting

ISBN: 9780077503956

1st Edition

Authors: Thomas Edmonds, Philip Olds, Frances McNair, Bor-Yi Tsay