Business Applications Case Lottery winnings consulting job The February 20, 2004, drawing for the Merg millions multistate

Question:

Business Applications Case Lottery winnings consulting job The February 20, 2004, drawing for the Merg millions multistate lottery produced one winning ticket. More than a month after the drawing no one had come forward to claim the \($239\) million prize. Perhaps the winner was simply confused about whether to take the winnings as a lump-sum, immediate payment, or annual payments over the next 26 years.

Assume that you work as a personal financial planner, and that one of your clients held the winning lottery ticket. Fie faces the choice of (1) taking annual payments of \($9,192,308\) over the next 26 years (\($239\) million 26), or (2) taking an immediate one-time payment of \($136\) million.

Required

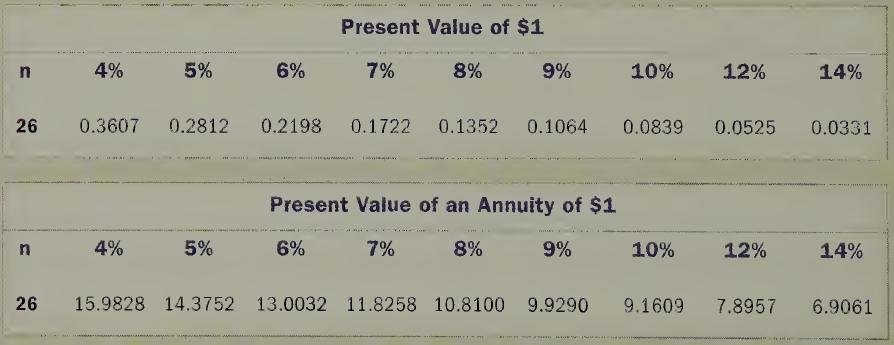

a. Assume you believe you can invest your client’s winnings and safely earn an average annual return of 7 percent. Should he take the immediate cash payment or should he take the 26 annual payments? Ignore tax considerations and show the supporting computations used to reach your answer.

b. Assume your client is not convinced you can safely earn an annual rate of 7 percent on his money. What is the minimum annual rate of return you would need to earn for him before he would be better off taking the immediate cash payout of \($136\) million rather than the 26 annual payments of \($9,192,308\) ? Ignore tax considerations and show the supporting computations used to reach your answer.

Step by Step Answer:

Survey Of Accounting

ISBN: 9780077503956

1st Edition

Authors: Thomas Edmonds, Philip Olds, Frances McNair, Bor-Yi Tsay