Eden Development Company has two competing investments. Proposal A and Proposal B. Proposals A and B have

Question:

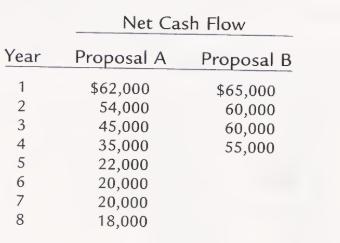

Eden Development Company has two competing investments. Proposal A and Proposal B. Proposals A and B have an initial investment of $175,000. The net cash flows estimated for the two investments are as follows:

The estimated residual value of Proposal A at the end of year 4 is $70,000.

Determine which proposal should be favored, comparing the net present values of the two investments and assuming a minimum rate of return of 15%. Use the table of present values in the chapter.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: