Holly Hocks Inc. had sales of ($225,000) for 2006, its first year of operation. On April 2,

Question:

Holly Hocks Inc. had sales of \($225,000\) for 2006, its first year of operation. On April 2, the company purchased 200 units of inventory at \($190\) per unit. On September 1, an additional 150 units were pur¬ chased for \($210\) per unit. The company had 50 units on hand at the end of the year. The company’s income tax rate is 40 percent. All transactions are cash transactions.

Required:

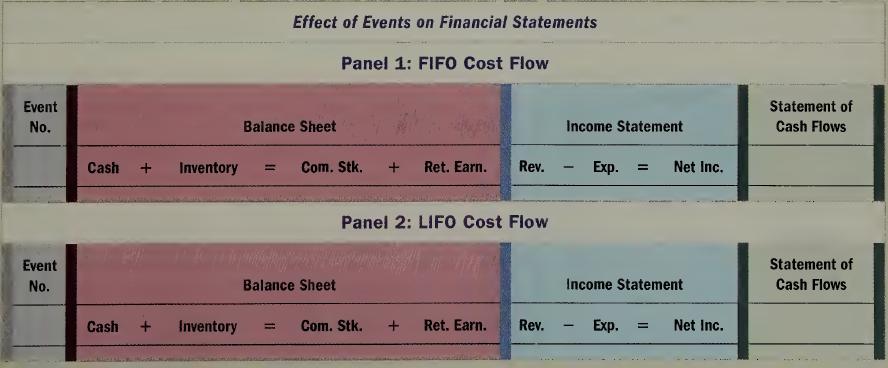

a. The preceding paragraph describes five accounting events: (1) a sales transaction, (2) the first purchase of inventory, (3) a second purchase of inventory, (4) the recognition of cost of goods sold expense, and (5) the payment of income tax expense. Record the amounts of each event in horizontal statements models like the following ones, assuming first a FIFO and then a LIFO cost flow.

b. Compute net income using FIFO.

c. Compute net income using LIFO.

d. Explain the difference, if any, in the amount of income tax expense incurred using the two cost flow assumptions.

e. How does the use of the FIFO versus the LIFO cost flow assumptions affect the statement of cash flows?

Step by Step Answer:

Survey Of Accounting

ISBN: 9780077503956

1st Edition

Authors: Thomas Edmonds, Philip Olds, Frances McNair, Bor-Yi Tsay