The following information pertains to the inventory of the La Bonne Company: During the year, La Bonne

Question:

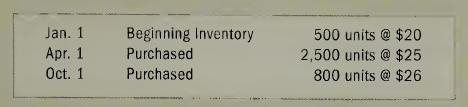

The following information pertains to the inventory of the La Bonne Company:

During the year, La Bonne sold 3,400 units of inventory at \($40\) per unit and incurred \($17,000\) of operating expenses. La Bonne currently uses the FIFO method but is considering a change to LIFO. All transactions are cash transactions. Assume a 30 percent income tax rate. La Bonne started the period with cash of \($42,000,\) inventory of \($10,000\), common stock of \($20,000\) and retained earnings of \($32,000\).

Required:

a. Prepare income statements using FIFO and LIFO.

b. Determine the amount of income taxes La Bonne would save if it changed cost flow methods.

c. Determine the cash flow from operating activities under FIFO and LIFO.

d. Explain why cash flow from operating activities is lower under FIFO when that cost flow method produced the higher gross margin.

Step by Step Answer: