New budget constraints have pressured Body Perfect Gym to control costs. The owner of the gym, Mr.

Question:

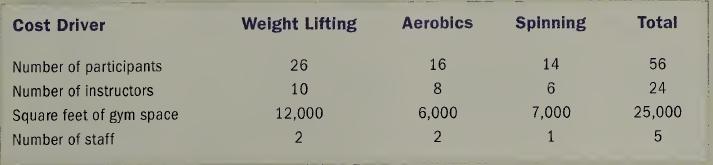

New budget constraints have pressured Body Perfect Gym to control costs. The owner of the gym, Mr. Ripple, has notified division managers that their job performance evaluations will be highly influenced by their ability to minimize costs. The gym has three divisions, weight lifting, aerobics, and spinning. The owner has formulated a report showing how much it cost to operate each of the three divisions last year. In preparing the report, Mr. Ripple identified several indirect costs that must be allocated among the divisions. These indirect costs are \($4,200\) of laundry expense, \($48,000\) of gym supplies, \($350,000\) of office rent, \($50,000\) of janitorial services, and \($120,000\) for administrative salaries. To provide a reasonably accurate cost allocation, Mr. Ripple has identified several potential cost drivers. These drivers and their association with each division follow.

Required:

a. Identify the appropriate cost objects.

b. Identify the most appropriate cost driver for each indirect cost, and compute the allocation rate for assigning each indirect cost to the cost objects.

c. Determine the amount of supplies expense that should be allocated to each of the three divisions.

d. The spinning manager wants to use the number of staff rather than the number of instructors as the allocation base for the supplies expense. Explain why the spinning manager would take this position.

e. Identify two cost drivers other than your choice for Requirement b that could be used to allocate the cost of the administrative salaries to the three divisions.

Step by Step Answer:

Survey Of Accounting

ISBN: 9780077503956

1st Edition

Authors: Thomas Edmonds, Philip Olds, Frances McNair, Bor-Yi Tsay