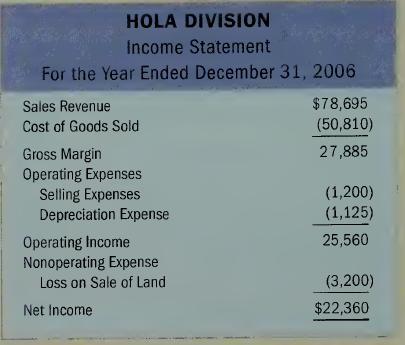

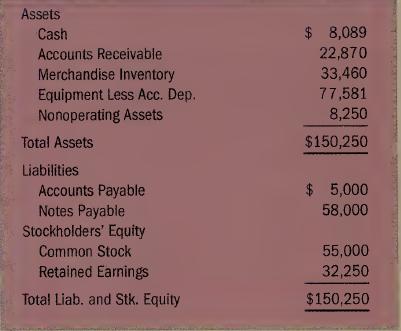

The following financial statements apply to Hola Division, one of three investment centers operated by Costa Corporation.

Question:

The following financial statements apply to Hola Division, one of three investment centers operated by Costa Corporation. Costa Corporation has a desired rate of return of 15 percent. Costa Corporation Headquarters has \($80,000\) of additional operating assets to assign to the investment centers.

Required

a. Should Costa use operating income or net income to determine the rate of return (ROI) for the Hola investment center? Explain.

b. Should Costa use operating assets or total assets to determine the ROI for the Hola investment center? Explain.

c. Calculate the ROI for Hola.

d. The manager of the Hola division has an opportunity to invest the funds at an ROI of 17 percent. The other two divisions have investment opportunities that yield only 16 percent. The manager of Hola rejects the additional funding. Why would the manager of Hola reject the funds under these circumstances?

e. Calculate the residual income from the investment opportunity available to Hola and explain how residual income could be used to encourage the manager to accept the additional funds.

Step by Step Answer:

Survey Of Accounting

ISBN: 9780077503956

1st Edition

Authors: Thomas Edmonds, Philip Olds, Frances McNair, Bor-Yi Tsay