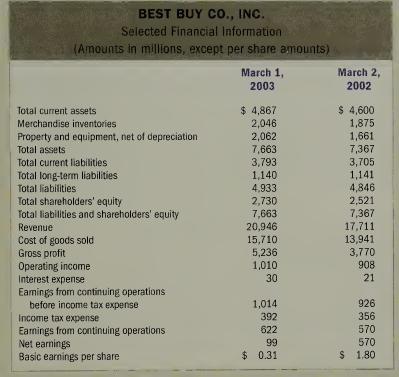

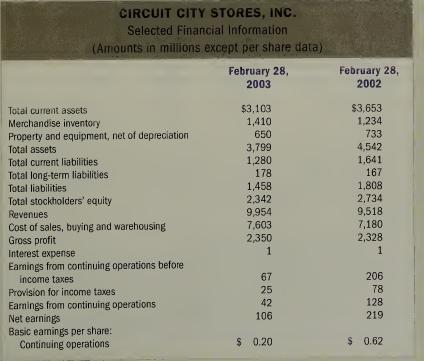

The following information relates to Best Buy and Circuit City Stores, Inc., for their 2003 and 2002

Question:

The following information relates to Best Buy and Circuit City Stores, Inc., for their 2003 and 2002 fiscal years.

Required:

a. Compute the following ratios for the companies’ 2003 fiscal years:

(1) Current ratio.

(2) Average number of days to sell inventory. (Use average inventory.)

(3) Debt to assets ratio.

(4) Return on investment. (Use average assets and use “earnings from continuing operations” rather than “net earnings.”)

(5) Gross margin percentage.

(6) Asset turnover. (Use average assets.)

(7) Return on sales. (Use “earnings from continuing operations” rather than “net earnings.”)

(8) Plant assets to long-term debt ratio.

b. Which company appears to be more profitable? Explain your answer and identify which of the ratio(s) from Requirement a you used to reach your conclusion.

c. Which company appears to have the higher level of financial risk? Explain your answer and identify which of the ratio(s) from Requirement a you used to reach your conclusion.

d. Which company appears to be charging higher prices for its goods? Explain your answer and identify which of the ratio(s) from Requirement a you used to reach your conclusion.

e. Which company appears to be the more efficient at using its assets? Explain your answer and identify which of the ratio(s) from Requirement a you used to reach your conclusion.

Step by Step Answer:

Survey Of Accounting

ISBN: 9780077503956

1st Edition

Authors: Thomas Edmonds, Philip Olds, Frances McNair, Bor-Yi Tsay