The following transactions apply to Mabry Equipment Sales Corp. for 2007: 1. The business was started when

Question:

The following transactions apply to Mabry Equipment Sales Corp. for 2007:

1. The business was started when Mabry Corp. received \($50,000\) from the issue of common stock.

2. Purchased \($175,000\) of merchandise on account.

3. Sold merchandise for \($200,000\) cash (not including sales tax). Sales tax of 8 percent is collected when the merchandise is sold. The merchandise had a cost of \($125,000\) .

4. Provided a six-month warranty on the merchandise sold. Based on industry estimates, the warranty claims would amount to 4 percent of merchandise sales.

5. Paid the sales tax to the state agency on \($150,000\) of the sales.

6. On September 1, 2007, borrowed \($20,000\) from the local bank. The note had a 6 percent interest rate and matures on March 1, 2008.

7. Paid \($5,600\) for warranty repairs during the year.

8. Paid operating expenses of \($54,000\) for the year.

9. Paid \($125,000\) of accounts payable.

10. Recorded accrued interest at the end of the year.

Required:

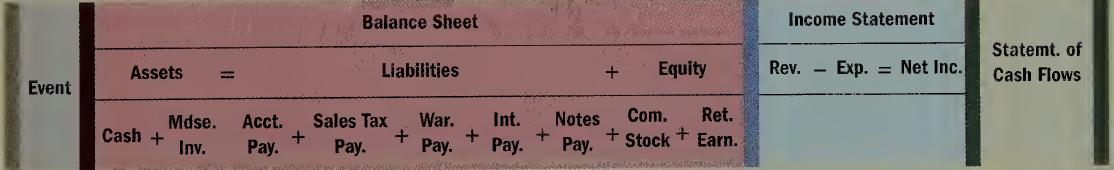

a. Record the above transactions in a horizontal statements model like the following one.

b. Prepare the income statement, balance sheet, and statement of cash flows for 2007

c. What is the total amount of current liabilities at December 31, 2007?

Step by Step Answer:

Survey Of Accounting

ISBN: 9780077503956

1st Edition

Authors: Thomas Edmonds, Philip Olds, Frances McNair, Bor-Yi Tsay