Use the financial statements for Pocca Company from Problem 9-22 to calculate the following ratios for 2006

Question:

Use the financial statements for Pocca Company from Problem 9-22 to calculate the following ratios for 2006 and 2005.

a. Working capital

b. Current ratio

c. Quick ratio

d. Accounts receivable turnover (beginning receivables at January 1, 2005, were \($47,000\) )

e. Average number of days to collect accounts receivable

f. Inventory turnover (beginning inventory at January 1, 2005, was \($140,000\) )

g. Average number of days to sell inventory h. Debt to assets ratio i. Debt to equity ratio j. Times interest earned k. Plant assets to long-term debt l. Net margin m. Asset turnover n. Return on investment o. Return on equity p. Earnings per share q. Book value per share of common stock r. Price-earnings ratio (market price per share: 2005, \($11.75\) ; 2006, \($12.50\) )

s. Dividend yield on common stock

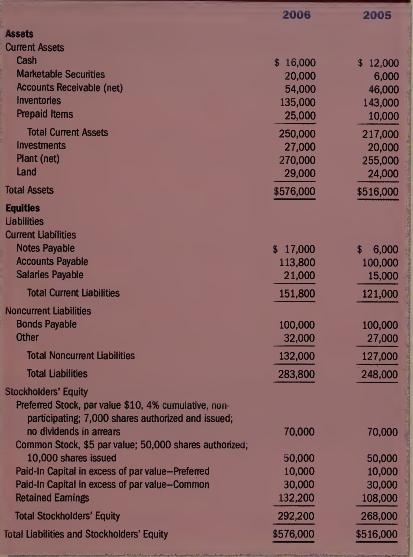

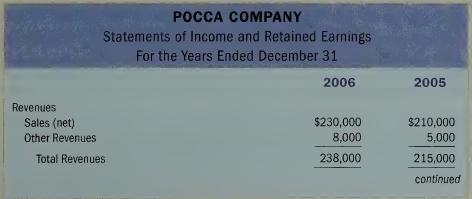

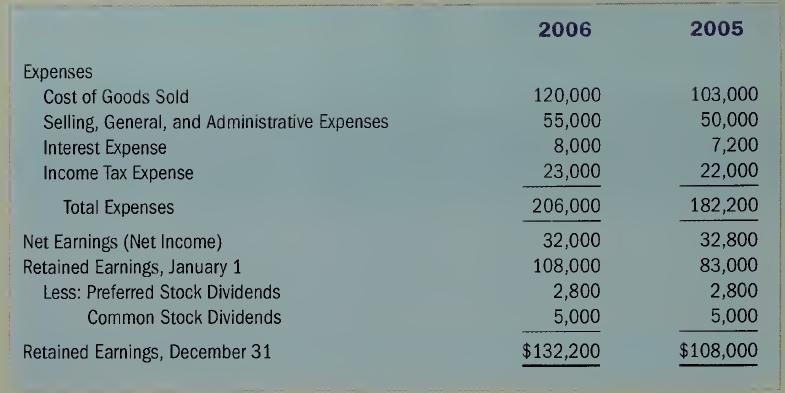

Data From Problem 9-22:-

Financial statements for Pocca Company follow.

Required:

Prepare a horizontal analysis of both the balance sheet and income statement.

Step by Step Answer:

Survey Of Accounting

ISBN: 9780077503956

1st Edition

Authors: Thomas Edmonds, Philip Olds, Frances McNair, Bor-Yi Tsay