Go to the IRS website (www.irs.gov) and print Form 4797: Sales of Business Property. Complete Form 4797

Question:

Go to the IRS website (www.irs.gov) and print Form 4797: Sales of Business Property.

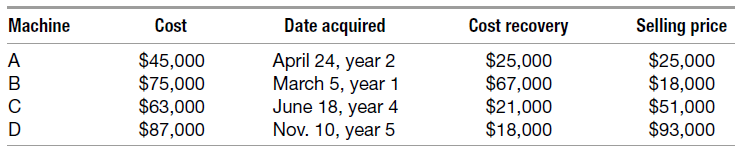

Complete Form 4797 for the following sales of machinery on December 20, year 6:

Transcribed Image Text:

Date acquired Machine Cost recovery Selling price Cost April 24, year 2 March 5, year 1 June 18, year 4 Nov. 10, year 5 $45,000 $75,000 $63,000 $87,000 $25,000 $67,000 $21,000 $18,000 $25,000 $18,000 $51,000 $93,000 A

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (15 reviews)

Form Department of the Treasury Internal Revenue Service Names shown on return 4797 2 3 4 Sales of Business Property Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280Fb2 a ...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Taxation For Decision Makers 2019

ISBN: 9781119497288

9th Edition

Authors: Shirley Dennis Escoffier, Karen A. Fortin

Question Posted:

Students also viewed these Business questions

-

Go to the IRS website (www.irs.gov) and print out a copy of Worksheet 1. Recapture of Alimony in the most recent IRS Publication 504, Divorced or Separated Individuals.

-

Go to the IRS website (www.irs.gov) and redo Problem 7 above using the most recent interactive Form 2441, Child and Dependent Care Expenses. Print out the completed Form 2441.

-

Go to the IRS website (www.irs.gov) and redo Problem 15, using the most recent interactive Form 4562, Depreciation and Amortization. Print out the completed Form 4562.

-

Widows DeVries and McAfee claimed their husbands died from cancer due to asbestos exposure while serving on Navy ships that included parts produced by Air & Liquid Systems Corp (ALS). Asbestos...

-

Describe the effects of thyroid and sex hormones on bone development and growth.

-

A number is to be selected from the interval {x : 0 < x < 2} by a random process. Let A i = {x : (i 1)/2 < x i/2}, i = 1, 2, 3, and let A4 = {x :3/2 < x < 2}. For i = 1, 2, 3, 4, suppose a certain...

-

Guilt in decision making. The effect of guilt emotion on how a decision maker focuses on a problem was investigated in the Jan. 2007 issue of the Journal of Behavioral Decision Making (see Exercise...

-

In Problem 34 in Chapter 1, when Tracy McCoy wakes up Saturday morning, she remembers that she promised the PTA she would make some cakes and/or homemade bread for its bake sale that afternoon....

-

Answer in this format please thank you!! Problem 13-5A Computing book values and dividend allocations LO C2, A4 [The following information applies to the questions displayed below.] Raphael...

-

Amanda Boleyn, an entrepreneur who recently sold her start-up for a multi-million-dollar sum, is looking for alternate investments for her newfound fortune. She is considering an investment in wine,...

-

Go to the IRS website (www.irs.gov) and print Schedule D for Form 1040 and Form 8949. Compute the net effect of the following asset sales on Gineen Tibeaus taxable income using Form 8949 and Schedule...

-

JB Manufacturing and BP Company exchange two pieces of land. JBs land has a basis of $800,000 and a fair market value of $750,000. BPs land has a basis of $560,000 and a fair market value of only...

-

What are the duties of the agent?

-

I have attached a case study, primarily based on your textbook chapter reading assignments. The background material for the case also references chapters 3 and 15, not assigned for this course....

-

On December 1 , 2 0 2 5 , Sandhill Distributing Company had the following account balances.DebitCash$ 7 , 1 0 0 Accounts Receivable 4 , 5 0 0 Inventory 1 1 , 9 0 0 Supplies 1 , 2 0 0 Equipment 2 2 ,...

-

Cindy Greene works at Georgia Mountain Hospital. The hospital experiences a lot of business closer to summer when the temperature is warmer. Cindy is meeting with her supervisor to go over the budget...

-

Use z scores to compare the given values. Based on sample data, newborn males have weights with a mean of 3247.4 g and a standard deviation of 575.4 g. Newborn females have weights with a mean of...

-

Gignment FULL SCAL Exercise 4- The following ndependent situations require professional judgment for determining when to recognize revenue from the transactions. Identify when revenue should be...

-

If productCost and productPrice are numeric variables, and productName is a string variable, which of the following statements are valid assignments? If a statement is not valid, explain why not. a....

-

Extend Algorithms 3.4 and 3.5 to include as output the first and second derivatives of the spline at the nodes.

-

The June profit and loss statement for the Browning Company is shown. If competitive conditions make price increases impossible and management has cut costs as much as possible, should the Browning...

-

Explain why a marketing audit might be desirable, even in a well-run company. Who or what kind of an organization would be best to conduct a marketing audit? Would a marketing research firm be good?...

-

This problem emphasizes the differences between the full-cost approach and contribution-margin approach to marketing cost analysis. Tapco, Inc., currently sells two products. Sales commissions and...

-

At a 3% (EAR) rate of interest, you will quadruple (increase four folds) your money in approximately ____ years.

-

Smile Company makes baked goods. The budgeted sales are $620,000, budgeted variable costs are $260,400, and budgeted fixed costs are $237,800. What is the budgeted operating income?

-

Analysis of a replacement project At times firms will need to decide if they want to continue to use their current equipment or replace the equipment with newer equipment. In this case, the company...

Study smarter with the SolutionInn App