Mango Corporation reports the following results for 2019: What is Mango Corporations taxable income for 2019? Gross

Question:

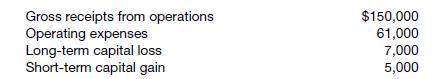

Mango Corporation reports the following results for 2019:

What is Mango Corporation’s taxable income for 2019?

Transcribed Image Text:

Gross receipts from operations Operating expenses Long-term capital loss Short-term capital gain $150,000 61,000 7,000 5,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

89000 taxable income 150000 61000 Th...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Taxation For Decision Makers 2020

ISBN: 9781119562108

10th Edition

Authors: Shirley Dennis Escoffier, Karen Fortin

Question Posted:

Students also viewed these Business questions

-

Raymond Corporation reports the following resuits for the current year: E (Click on the icon to view the results for the current year ) (Click on the icon to view the tax rate schedule.) Requirement...

-

Zeta Corporation reports the following results for Year 1 and Year 2: The adjusted taxable income is before Zeta claims any charitable contributions deduction, NOL or capital loss carryback,...

-

Perez Corporation reports the following results for 2019: a. What is Perez Corporations taxable income for 2019? b. How would Perez Corporations taxable income change if it had a $10,000 NOL...

-

Benny sells an apartment building. His adjusted basis for regular income tax purposes is $450,000, and it is $475,000 for AMT purposes. He receives $700,000 from the sale. a. Calculate Bennys gain...

-

Assigning the numbers 1 through 7, identify the order in which the following budgets are prepared. Direct labor budget Production budget Selling, administrative, and general expenses budget Budgeted...

-

When you apply proportional brushing, what do you apply it to in the target sheet?

-

Are there stereotypes about motivation of public employees? What are they? Do you think they are true? LO.1

-

The accountant for Evas Laundry prepared the following unadjusted and adjusted trial balances. Assume that all balances in the unadjusted trial balance and the amounts of the adjustments are correct....

-

33 First National Bank buys and sells securities. The company's fiscal year ends on December 31. The following selected transactions relating to First National's trading account occurred during the...

-

Velvet Corporation has revenues of $340,000 and deductible expenses of $350,000. It also received a $40,000 dividend from a corporation in which it owns 10 percent. What is the corporations taxable...

-

Barbara sold three assets during 2019. How much and what kind of gain or loss does she recognize from each sale? What tax rate applies to the net gain if Barbara is a single individual with $160,000...

-

Jonathan took an admission test for the University of California and scored in the 85th percentile. The following year, Jonathans sister Kendra took a similar admission test for the University of...

-

How do we design an electromagnetic sensor?

-

What is a virtual breadboard?

-

Joe secured a loan of $13,000 four years ago from a bank for use toward his college expenses. The bank charges interest at the rate of 9%/year compounded monthly on his loan. Now that he has...

-

Answer these two questions 1 32 2 Number of Units Sold 3 4 ! Direct Material units per unit of production 5 i 6 Total Direct Materials Used 7! 8 Price Per Unit 9 10 Cost of Direct Materials 11 12 13...

-

Give an algorithm for converting a tree to its mirror. Mirror of a tree is another tree with left and right children of all non-leaf nodes interchanged. The trees below are mirrors to each other....

-

What is meant by the "market rate" of interest, the "effective rate" of interest, and the "yield rate" of interest?

-

True & False The basis of an asset must be reduced by the depreciation allowable, 2. Adjusted gross income (AGI) is the basis for a number of phase-outs of deductions. 3. A change to adjusted gross...

-

John and Mary are divorcing. John is demanding that Mary pay him $75,000 of alimony in the first year after the divorce, $50,000 in the second year, and $25,000 in the third and all subsequent years...

-

John and Mary are divorcing. John is demanding that Mary pay him $75,000 of alimony in the first year after the divorce, $50,000 in the second year, and $25,000 in the third and all subsequent years...

-

Joe owes Willy $5,000 from an old gambling debt. Joe knows that there is no way he can repay the debt in the near future. He asks Joe if he will take a $25,000 life insurance policy that has a cash...

-

Dr. Claudia Gomez, a plastic surgeon, had just returned from a conference in which she learned of a new surgical procedure for removing wrinkles around eyes, reducing the time to perform the normal...

-

QUESTION 2 ( 2 0 Marks ) 2 . 1 REQUIRED Study the information provided below and prepare the Income Statement for the year ended 3 1 December 2 0 2 3 using the marginal costing method. INFORMATION...

-

DROP DOWN OPTIONS: FIRST SECOND THIRD FOURTH 5. Cost of new common stock A firm needs to take flotation costs into account when it is raising capital fromY True or False: The following statement...

Study smarter with the SolutionInn App