Your client, Ted, would like your assistance in selecting one of the following assets to give to

Question:

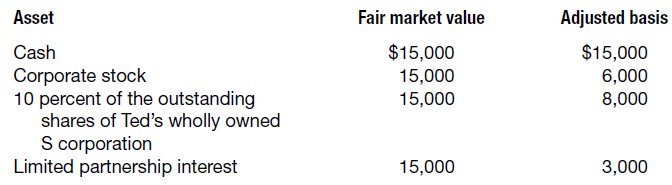

Your client, Ted, would like your assistance in selecting one of the following assets to give to his 16-year-old daughter.

The corporate stock pays only $100 in dividend income each year but has doubled in value since Ted purchased it three years ago. The S corporation has generated a profit of $80,000 each year for the past three years and is expected to perform even better in the future. The limited partnership has generated losses for the past three years and is expected to do so for at least the next several years.

a. Discuss the advantages and disadvantages from both transfer and income tax perspectives for each asset as a potential gift.

b. Which asset do you recommend Ted choose and why?

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Taxation For Decision Makers 2019

ISBN: 9781119497288

9th Edition

Authors: Shirley Dennis Escoffier, Karen A. Fortin