Joaquin is a 30 percent partner in the SBD Partnership, a calendar-year-end entity. As of the end

Question:

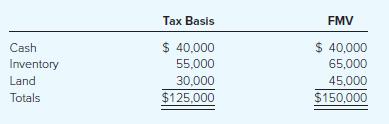

Joaquin is a 30 percent partner in the SBD Partnership, a calendar-year-end entity. As of the end of this year, Joaquin has an outside basis in his interest in SBD of $188,000, which includes his share of the $60,000 of partnership liabilities. On December 31, SBD makes a proportionate distribution of the following assets to Joaquin:

a) What are the tax consequences (amount and character of recognized gain or loss, basis in distributed assets) of the distribution to Joaquin if the distribution is an operating distribution?

b) What are the tax consequences (amount and character of recognized gain or loss, basis in distributed assets) of the distribution to Joaquin if the distribution is a liquidating distribution?

c) Compare and contrast the results from parts (a) and (b).

Step by Step Answer:

Taxation Of Individuals And Business Entities 2023 Edition

ISBN: 9781265790295

14th Edition

Authors: Brian Spilker, Benjamin Ayers, John Barrick, Troy Lewis, John Robinson, Connie Weaver, Ronald Worsham