A company (which is not a member of a group) has the following results for the 14

Question:

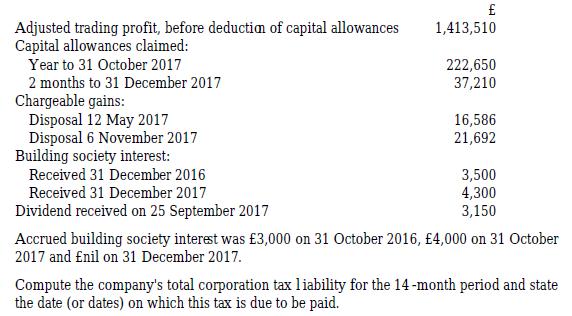

A company (which is not a member of a group) has the following results for the 14 months to 31 December 2017:

Transcribed Image Text:

Adjusted trading profit, before deduction of capital allowances Capital allowances claimed: Year to 31 October 2017 2 months to 31 December 2017 Chargeable gains: Disposal 12 May 2017 Disposal 6 November 2017 Building society interest: Received 31 December 2016 Received 31 December 2017 Dividend received on 25 September 2017 1,413,510 222,650 37,210 16,586 21,692 3,500 4,300 3,150 Accrued building society interest was 3,000 on 31 October 2016, 4,000 on 31 October 2017 and Enil on 31 December 2017. Compute the company's total corporation tax liability for the 14-month period and state the date (or dates) on which this tax is due to be paid.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (2 reviews)

To compute the companys total corporation tax liability for the 14month period ended 31 December 2017 the following steps are to be taken 1 Adjust the trading profit for the taxation period by deducti...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

A company (which is not a member of a group) has the following results for the 14 months to 31 December 2021: Accrued building society interest was 3,000 on 31 October 2020, 4,000 on 31 October 2021...

-

A company has the following results for the 14 months to 31 December 2020: Adjusted trading profit, before deduction of capital allowances 1,413,510 Capital allowances claimed: Year to 31 October...

-

A company has the following results for the 14 months to 31 December 2020: Adjusted trading profit, before deduction of capital allowances 1,413,510 Capital allowances claimed: Year to 31 October...

-

Many auditors consider the substantiation of the figure for inventory to be a more difficult and challenging task than the verification of most other items on the balance sheet. List several specific...

-

Cyclopropyl chloride has been prepared by the free-radical chlorination of cyclopropane. Write a stepwise mechanism for this reaction.

-

Book Values versus Market Values Explain the difference between book value and market value. Under standard accounting rules, it is possible for a companys liabilities to exceed its assets. When this...

-

List the outcome(s) of the event It rains all three days.

-

The American Association of Individual Investors (AAII) On-Line Discount Broker Survey polls members on their experiences with electronic trades handled by discount brokers. As part of the survey,...

-

the company predicts that 5 percent of its credit sales will never be collected. 35 percent of its sales will be collected in the month of the sale,and the remaining 60 percent will be collected in...

-

Timberlake Ltd prepares accounts to 31 March each year. The company made the following disposals of chargeable assets in the year to 31 March 2018: (i) In February 2018 , a rare Bentley motor car...

-

A company bought a chargeable asset in November 2000 for 15,000. Enhance ment expenditure was 2,000 in January 2002 and 3,000 in June 2006 . The asset was sold in February 2018 for 48,000. RPIs are...

-

Can I describe my job and educational history without hesitation? LO.1

-

how is lateral force(fy) determined from this data Tyre Responses 1 1 1 1 1 1.3 1.3 1.3 1.3 1.3 1.6 1.55 1.45 1.27 1.1 Fz (N) 0 400 800 1200 1500 Slip Angle (deg) Fy1 (N) Fy2 (N) Fy3 (N) 0.0 0 0 0.5...

-

(13%) Problem 8: A wire is oscillated to create a wave of the form y(x,t) = Asin(x - 30t) == The wave is reflected from a fixed end producing a reflection of the form y2(x,t) = A sin(x + 30t) The two...

-

Using the definitions of even integer and odd integer, give a proof by contraposition that this statement is true for all integers n: If 5n+3 is even, then n is odd.

-

7. Design the formwork for a wall 8-ft (2.44-m) high to be poured at the rate of 5 ft/h (1.53 m/h) at a temperature of 77F (25C). The concrete mixture will use Type I cement without retarders and is...

-

tempt in Progress The City of Minden entered into the following transactions during the year 2026. 1. A bond issue was authorized by vote to provide funds for the construction of a new municipal...

-

The income statement figures for the past five years for Phom Ltd are presented in the question. Prepare a trend analysis and a vertical analysis (using sales revenue as the base amount) and comment...

-

For what reason might an exporter use standard international trade documentation (letter of credit, draft, order bill of lading) on an intrafirm export to its parent or sister subsidiary?

-

State the date (or dates) on which a "large" company would be required to settle its corporation tax liability for each of the following accounting periods: Assume in each case that the company's tax...

-

A company calculates its corporation tax liability for the year to 31 August 2020 as 120,000 and pays this amount on 1 June 2021. The company's corporation tax return is submitted during August 2021...

-

A company (which is not a member of a group) prepares a set of accounts for the year to 30 September 2021. Calculate the corporation tax liability for the year and state the date (or dates) on which...

-

Suppose First Fidelity Bank engaged in the following transactions: (Click the icon to view the transactions.) Journalize the 2018 and 2019 transactions on First Fidelity's books. Explanations are not...

-

Financial data for Joel de Paris, Inc., for last year follow: Joel de Paris, Inc. Balance Sheet Beginning Balance Ending Balance Assets Cash Accounts receivable Inventory Plant and equipment, net...

-

Supply costs at Coulthard Corporation's chain of gyms are listed below: March April May June July August September October November Client-Visits 11,666 11,462 11,994 13,900 11,726 11, 212 12,006...

Study smarter with the SolutionInn App