During the quarter to 31 December 2020, a taxable person makes the following supplies: Input tax for

Question:

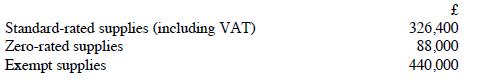

During the quarter to 31 December 2020, a taxable person makes the following supplies:

Input tax for the quarter is £118,000. Of this input tax, 35% is attributed to taxable supplies, 40% is attributed to exempt supplies and 25% is unattributed. Compute the VAT provisionally payable to or reclaimable from HMRC for the quarter.

Transcribed Image Text:

Standard-rated supplies (including VAT) Zero-rated supplies Exempt supplies 326,400 88,000 440,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

To compute the VAT provisionally payable to or reclaimable from HMRC for the quarter we need to calc...View the full answer

Answered By

Talha Talib

I am a member of IEEE society. As i am a student of electrical engineering badge 17 but beside of this i am also a tutor in unique academy. I teach calculus, communication skills, mechanics and economics. I am also a home tutor. My student Muhammad Salman Alvi is a brilliant A-level student and he performs very well in academics when i start to teach him. His weak point was mathematics but now he is performing well in mathematics. I am a scholarship holder in Fsc as i scored 1017 marks in metric out of 1100. Later on i got scholarship in Punjab Group of Colleges. I got 2nd position in robotics competition in 2018 as my project home automation select for the exhibition in Expocentre.

4.60+

23+ Reviews

62+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

During the quarter to 31 December 2017, a taxable person makes the following supplies: Standard-rated supplies (including VAT) Zero-rated supplies Exempt supplies Input tax for the quarter is...

-

During the quarter to 31 December 2021, a taxable person makes the following supplies: Input tax for the quarter is 118,000. Of this input tax, 35% is attributed to taxable supplies, 40% is...

-

During the quarter to 31 December 2017, Nancy makes supplies as follows: Standard-rated supplies (excluding VAT) Zero-rated supplies Exempt supplies She suffers input tax as follows: Attributed to...

-

Craig Industries was in the business of manufacturing charcoal. Craig, the corporation's president, contracted in the name of the corporation to sell the company's plants to Husky Industries. Craig...

-

Corbin reported adjusted gross income of $170,000. Other information is as follows. Standard deduction..............................................$ 6,300 Personal...

-

Exercise 2 In the 2020-2021 academic year, many universities and colleges considered designating credit for all courses as simply pass/fail. Suppose the University of Illinois surveyed its students...

-

What is wrong with the idea of just expecting people to adapt to a new system by compliance? AppendixLO1

-

Jennifer Willis worked for Coca Cola Enterprises, Inc. (CCE), in Louisiana as a senior account manager. On a Monday in May 2003, Willis called her supervisor to tell him that she was sick and would...

-

Comfort Corporation manufactures two models of office chairs, a standard and a deluxe model. The following activity and cost information has been compiled: Product Number of Setups Number of...

-

Tracey is a sole trader. She has the following transactions during the quarter to 31 December 2020 (all amounts shown are VAT-exclusive): Tracey drives a car with an emission rating of 114 g/km and...

-

Sebastian is self-employed. He drives a car with an emission rating of 173 g/km and he charges the cost of all the petrol used to his business bank account. In the quarter to 31 July 2020, he uses...

-

Each capital project evaluation method has certain underlying assumptions and limitations. Payback method >- Assumptions The speed of investment recovery is the most important investment criterion,...

-

The Buckle, Inc., operates 387 stores in 39 states, selling brand name apparel like Lucky jeans and Fossil belts and watches. Some of the items included in its 2008 statement of cash flows presented...

-

Assume that on July 1, 2011, Big Corp. loaned Little Corp. \(\$ 12,000\) for a period of one year at 6 percent interest. What amount of interest revenue will Big report for 2011? What amount of cash...

-

A vacuum column with 25 real stages is operating with a pressure drop of \(0.3 \mathrm{in}\). of water per stage. Assume pressure drop in the condenser and the reboiler is 0.6 in. of water each. The...

-

You want to determine the viscosity of an oil which has an SG of 0.9. To do this, you drop a spherical glass bead $(\mathrm{SG}=2.7)$ with a diameter of $0.5 \mathrm{~mm}$ into a large vertical...

-

Show that 673 - 356 can be computed by adding 673 to the 10's complement of 356 and discarding the end carry. Draw the block diagram of a three-stage decimal arithmetic unit and show how this...

-

Suggest a poka-yoke device for each of the following and indicate whether the device is of the warning or control type. a. Filling an automobile crankcase with the correct amount of oil b. Ensuring...

-

A 6-lb shell moving with a velocity ?? v0k explodes at point D into three fragments which hit the vertical wall at the points indicated. Fragments A, B, and C hit the wall 0.010 s, 0.018 s, and 0.012...

-

The tax credit for rehabilitation expenditures is available to help offset the costs related to substantially rehabilitating certain buildings. The credit is calculated on the rehabilitation...

-

Tom, a calendar year taxpayer, informs you that during the year, he incurs expenditures of $40,000 that qualify for the incremental research activities credit. In addition, it is determined that his...

-

Using the legend provided, indicate which form of business entity each of the following characteristics describes. Some of the characteristics may apply to more than one form of business entity....

-

crane Inc. common chairs currently sell for $30 each. The firms management believes that it's share should really sell for $54 each. If the firm just paid an annual dividend of two dollars per share...

-

Determine the simple interest earned on $10,000 after 10 years if the APR is 15%

-

give me an example of 10 transactions from daily routine that we buy and put for me Liabilities + Owners' Equity + Revenues - Expenses

Study smarter with the SolutionInn App