Tracey is a sole trader. She has the following transactions during the quarter to 31 December 2020

Question:

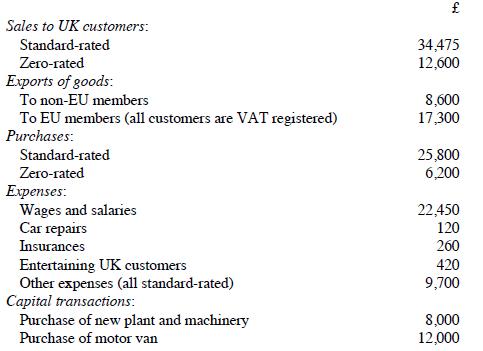

Tracey is a sole trader. She has the following transactions during the quarter to 31 December 2020 (all amounts shown are VAT-exclusive):

Tracey drives a car with an emission rating of 114 g/km and reclaims input tax on all of the fuel used by this car, whether for business or private motoring. She does not keep detailed mileage records. Calculate the amount of VAT due for the quarter.

Transcribed Image Text:

Sales to UK customers: Standard-rated Zero-rated Exports of goods: To non-EU members To EU members (all customers are VAT registered) Purchases: Standard-rated Zero-rated Expenses: Wages and salaries Car repairs Insurances Entertaining UK customers Other expenses (all standard-rated) Capital transactions: Purchase of new plant and machinery Purchase of motor van 115 34,475 12,600 8,600 17,300 25,800 6,200 22,450 120 260 420 9,700 8,000 12,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

To calculate the amount of VAT due for the quarter we need to compute the VAT on Traceys sales subtr...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Tracey is a sole trader. She has the following transactions during the quarter to 31 December 2017 (all amounts shown are VAT-exclusive): Tracey drives a car with an emission rating of 16 4 g/km and...

-

Tracey is a sole trader. She has the following transactions during the quarter to 31 December 2017 (all amounts shown are VAT-exclusive): Tracey drives a car with an emission rating of 16 4 g/km and...

-

Tracey is a sole trader. She has the following transactions during the quarter to 31 December 2021 (all amounts shown are VAT-exclusive): Tracey drives a car with an emission rating of 128 g/km and...

-

This case will enable you to practice conducting planning and substantive analytical procedures for accounts in the revenue cycle. When analyzing the financial data, you may assume that the 2015...

-

The IRS provides a web-based tool to help taxpayers determine whether they are eligible for the earned income tax credit. Locate this tool at the IRS website. Then apply the facts related to a...

-

Problem: A furniture company makes two types of rocking chairs, a plain chair and a fancy chair. Each rocking chair must be assembled and then finished. The plain chair takes 4 hours to assemble and...

-

How does change management fit with project management? AppendixLO1

-

Balfour Corp. has the following operating results and capital structure ($000). The firm is contemplating a capital restructuring to 60% debt. Its stock is currently selling for book value at $25 per...

-

Builder Products, Inc., uses the weighted-average method in its process costing system. It manufactures a caulking compound that goes through three processing stages prior to completion. Information...

-

Tania makes no transfers during 2018-19. Her only transfers during 2019-20 and 2020-21 are as follows: Calculate the value of each of the above transfers after deduction of all the relevant...

-

During the quarter to 31 December 2020, a taxable person makes the following supplies: Input tax for the quarter is 118,000. Of this input tax, 35% is attributed to taxable supplies, 40% is...

-

Suppose that f (t) is a solution of the differential equation y = ty - 5 and the graph of f (t) passes through the point (2, 4). What is the slope of the graph at this point?

-

Consider a piston with an orifice in a cylinder filled with a fluid of viscosity \(\mu\) as shown in Fig. 1.106. As the piston moves in the cylinder, the fluid flows through the orifice, giving rise...

-

Add a function to SmallWorld that computes the global clustering coefficient of a graph. The global clustering coefficient is the conditional probability that two random vertices that are neighbors...

-

Show that the generators of the algebra (33.8) are related by parity. For a Dirac wavefunction the action of parity is $P \psi(\boldsymbol{x}, t) P^{-1}=\gamma_{0} \psi(-\boldsymbol{x}, t)$, up to a...

-

Extend the algorithm you designed for Exercise 6.2 so that it can evaluate positions that are nonterminalin other words, positions where the game has not yet finished. Your score should be positive...

-

In addition to tanh, another s-shaped smooth function, the logistic sigmoid function y=1 / (1+exp(x)), is commonly used as an activation function in neural networks. A common way to implement them in...

-

Classify each of the following number streams with respect to its corresponding measurement scale: nominal, ordinal, interval or ratio. a. List of 10 part numbers b. Hourly temperature readings taken...

-

In Problem 8.43, determine the smallest value of for which the rod will not fall out of the pipe. IA -3 in.-

-

In each of the following independent situations, determine the tentative minimum tax. Assume that the company is not in small corporation status. AMTI (before the Exemption Amount) Quincy Corporation...

-

Included in Alices regular taxable income and in her AMT base is a $300,000 capital gain on the sale of stock she owned for three years. Alice is in the 35% tax bracket for regular income tax...

-

In the current year, Paul Chaing (4522 Fargo Street, Geneva, IL 60134) acquires a qualifying historic structure for $350,000 (excluding the cost of the land) and plans to substantially rehabilitate...

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

-

Required information [The following information applies to the questions displayed below.] Dain's Diamond Bit Drilling purchased the following assets this year. Asset Drill bits (5-year) Drill bits...

-

Which of the following partnership items are not included in the self-employment income calculation? Ordinary income. Section 179 expense. Guaranteed payments. Gain on the sale of partnership...

Study smarter with the SolutionInn App