In 2010, Shaun bought 20% of the ordinary shares of an unlisted trading company. The shares cost

Question:

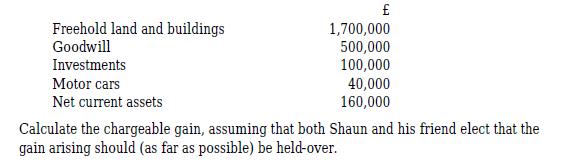

In 2010, Shaun bought 20% of the ordinary shares of an unlisted trading company. The shares cost £140,000. He owned the shares until January 2018 when he gave all the shares to a friend. On the date of the gift, the shares had a market value of £500,000 and the company's assets were valued as follows:

Transcribed Image Text:

Freehold land and buildings Goodwill Investments Motor cars Net current assets 1,700,000 500,000 100,000 40,000 160,000 Calculate the chargeable gain, assuming that both Shaun and his friend elect that the gain arising should (as far as possible) be held-over.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (6 reviews)

To calculate the chargeable gain we first need to determine the gain that was made by Shaun on the disposal of his shares Since Shaun gave the shares ...View the full answer

Answered By

GERALD KAMAU

non-plagiarism work, timely work and A++ work

4.40+

6+ Reviews

11+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

In 2014, Shaun bought 20% of the ordinary shares of an unlisted trading company. The shares cost 140,000. He owned the shares until January 2022 when he gave all the shares to a friend. On the date...

-

On 6 April 2021, Harry Johnson, aged 38, started employment with, Queens words Ltd as a proof-reader. On the 11 January 2022, Harry also entered into a partnership with his friend Debra. Together...

-

The financial statements of JJ Ltd and KK Ltd for the year to 30 June 2018 are shown below: Statements of comprehensive income for the year to 30 June 2018. Statements of financial position as at 30...

-

Jaclyn Hargrove is the owner of six Pickwick Restaurants. For the past 10 years, she has always relied on her accountant to analyze her financial statements. Jaclyn feels that if she were able to...

-

Give the structure of the principal organic product formed by free-radical bromination of each of the following: (a) Methylcyclopentane (c) 2, 2, 4-Trimethylpentane (b)...

-

Talent may be bought in or home-grown and the organisation needs to decide the most appropriate balance between the two. Methods of identifying potential include assessment/development centres,...

-

The probability of randomly choosing a tea drinker who has a college degree (Assume that you are choosing from the population of all tea drinkers.)

-

Cowen Company began its operations in August of the current year. During August and September, the company paid wages of $2,450. For the last quarter of the year, the taxable wages paid amounted to...

-

Net Present Value Method , Internal Rate of Return Method , and Analysis The management of Advanced Alternative Power Inc. is considering two capital investment projects. The estimated net cash flows...

-

A manufacturing company has the following results for the year to 31 March 2018: Trading income Income from property Bank interest (amount received) Interest on Government securities (amount...

-

(a) Warren's liability to income tax and Class 4 NICs for tax year 2016 -17 was 17,200, of which 14,500 was paid via PAYE. (i) Compute his POAs for 2017-18 and state the dates on which these fall...

-

What happened when the punishment contingency was resumed? LO6

-

If you are a Super Coffee company and want to partner with Influencers on Instagram. How to find them? Influencer suggestions? How much to pay them? Who are they? Your budget is $250,000 So...

-

As the Customer Support Manager in the Fast-Moving Consumer Good (FMCG) sector with the ABC Corporation you are expected to address major grievances of customers from our product line and special...

-

An agent for positive change can be defined as someone who has the capability to influence and motivate those around them to accomplish whatever shared task needed to achieve a common goal, these...

-

Identify stress-reduction techniques used in organizations (e.g., wellness programs) Evaluate the impact of personal and work-related stress on performance Explain the relationship between...

-

Company: Viventium Explain which metrics you recommend tracking and why. For example, "these are the 3 to 5 metrics I've chosen; I'm tracking this because it does X, thereby bringing me closer to...

-

The following is an extract of an article discussing the importance of companies disclosing information in annual reports. Companies are still failing to provide a full and clear picture of their...

-

Trade credit from suppliers is a very costly source of funds when discounts are lost. Explain why many firms rely on this source of funds to finance their temporary working capital.

-

Barbara (see Example 2 above) makes the following payments for 2020-21: Compute the late payment penalties (if any) which Barbara would incur and state the dates by which these penalties should be...

-

Barbara's liability to income tax and Class 4 NICs for tax year 2019-20 was 26,000, of which 4,000 was paid by deduction at source. Her liability for 2020-21 is 30,000, of which 1,000 has been...

-

(a) Warren's liability to income tax and Class 4 NICs for tax year 2019-20 was 17,200, of which 14,500 was paid via PAYE. (i) Compute his POAs for 2020-21 and state the dates on which these fall due....

-

You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company...

-

Brief Exercise 10-6 Flint Inc. purchased land, building, and equipment from Laguna Corporation for a cash payment of $327,600. The estimated fair values of the assets are land $62,400, building...

-

"faithful respresentation" is the overriding principle that should be followed in ones prepaparation of IFRS-based financial statement. what is it? explain it fully quoting IAS. how this this...

Study smarter with the SolutionInn App