In 2013, Shaun bought 20% of the ordinary shares of an unlisted trading company. The shares cost

Question:

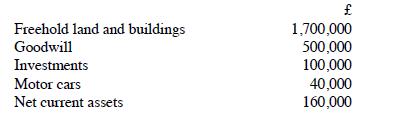

In 2013, Shaun bought 20% of the ordinary shares of an unlisted trading company. The shares cost £140,000. He owned the shares until January 2021 when he gave all the shares to a friend. On the date of the gift, the shares had a market value of £500,000 and the company's assets were valued as follows:

Calculate the chargeable gain, assuming that both Shaun and his friend elect that the gain arising should (as far as possible) be held-over.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: