T Ltd has owned 90% of the ordinary share capital of B Ltd for many years. Both

Question:

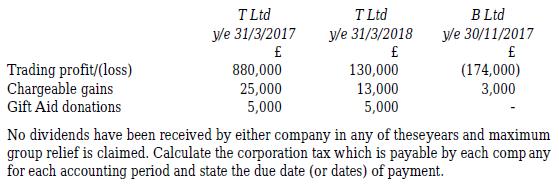

T Ltd has owned 90% of the ordinary share capital of B Ltd for many years. Both are UK resident. Recent results for the two companies are as follows:

Transcribed Image Text:

Trading profit/(loss) Chargeable gains Gift Aid donations T Ltd y/e 31/3/2017 880,000 25,000 5,000 T Ltd y/e 31/3/2018 130,000 13,000 5,000 B Ltd y/e 30/11/2017 (174,000) 3,000 No dividends have been received by either company in any of these years and maximum group relief is claimed. Calculate the corporation tax which is payable by each company for each accounting period and state the due date (or dates) of payment.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (1 review)

To calculate the corporation tax payable for each company for each accounting period we need to follow the tax laws and regulations pertinent to UK re...View the full answer

Answered By

Avinash kumar Deo

A strong finance professional with a Bachelor's degree focusing on Accountancy, Finance & Economics. I am an experienced Finance & Accounting expert with a demonstrated history of working in different industries like real estate and education. I also have experience in statutory audit as an associate.

I am skilled at Tally ERP, MS Word, Excel & PowerPoint.

Currently, I am a freelance content creator. I worked on different platforms such as Chegg and Evelyn learning systems.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Farnsworth Television makes and sells portable television sets. Each television regularly sells for $200 and has the following costs. Direct materials, Direct labor. Manufacturing overhead 75%...

-

T Ltd has owned 90% of the ordinary share capital of B Ltd for many years. Both are UK resident. Recent results for the two companies are as follows: No dividends have been received by either company...

-

Mr. Walmart the managing director of Sand Ltd meet your manager. Extracts from the email prepared by your manager (a) Sand Ltd group of companies Sand Ltd has two wholly owned subsidiaries, Dump Ltd...

-

Host A has a file of 49.5Kbytes to send to host C and host B has a file of 70.5Kbytes to send to host D, both using TCP. TCP connection 1 from A to C and TCP connection 2 from B to D share one...

-

Compound A (C6H14) gives three different monochlorides on photochemical chlorination. One of these monochlorides is inert to E2 elimination. The other two monochlorides yield the same alkene B...

-

In exercise 1, the following estimated regression equation based on 10 observations was presented. The values of SST and SSR are 6724.125 and 6216.375, respectively. a. Find SSE. b. Compute R2 . c....

-

Record the following transactions in an Analytical Petty Cash Book under imprest system as on 1st April 2001. The petty cashier had a balance of ` 2500. 2001 April 1 Postage stamps purchased ` 55 3...

-

Supermart Food Stores (SFS) has experienced net operating losses in its frozen food products line in the last few periods. Management believes that the store can improve its profitability if SFS...

-

Fixed costs are the costs of actually acquiring the new equipment that you will need to make the plan actually happen. True

-

Roy owns 3,500 ordinary shares in an unlisted company which has an issued share capital of 10,000 ordinary shares. Roy's wife owns a further 1,600 shares. Shareholdings in the company are valued as...

-

S Ltd has taxable total profits of 120,000 for the six months to 30 September 2017 and receives no dividends. Until 1 June 2017, S Ltd had no related 51% group companies. However, on that date, its...

-

Which of the following describes an IASB requirement that the FASB has adopted as part of the short-term convergence project? LO4 a. Following the IASB format for presentation of a statement of...

-

int rFibNum(int a, int b, int n) { if(n == 1) return a; else if( n == 2) return b; else return rFibNum(a,b, n-1) + rFibNum(a, b, n-2); } In the code above; a) how many base cases are there? b) what...

-

Watch the Super Nanny (i.e., Jo Frost) episode "The Orm Family" (Season 1, Episode 3) and answer the following questions. Unless otherwise specified, your answers should focus on Declan (the 3 year...

-

2. Suppose Ford officials were asked to justify their decision. What moral principles do you think they would invoke? Assess Ford's handling of the Pinto from the perspective of each of the moral...

-

2. You have been asked to design the proto-type of an Automatic Grocery Vending Machine 10 (AGVM) for the super store. Automatic Grocery Vending Machine (AGVM) is a machine where different types of...

-

1. What does Porter's 5 Forces analysis strategy do? 2. Do most people agree Why? or disagree with this aspect Why? Here is the reference video, https://www.youtube.com/watch?v=Dfp23xSqpdk 3. What...

-

In the Whine Company, it costs $20 per unit ($15 variable and $5 fixed) to make a product that normally sells for $45. A foreign wholesaler offers to buy 3000 units at $25 each. The Whine Company...

-

In July 2013, cnet.com listed the battery life (in hours) and luminous intensity (i. e., screen brightness, in cd/m2) for a sample of tablet computers. We want to know if screen brightness is...

-

Which of the following disposals might give rise to a CGT liability? (a) The sale of antique furniture by a UK company, (b) The gift of shares from husband to wife (assuming that the couple live...

-

Leonard is employed and received a gross salary of 3,452 per month during tax year 2021-22. He also has a small business and paid 52 Class 2 NICs for the year. His trading income for 2021-22 was...

-

Brenda is a company director and she earns a regular monthly salary of 6,000. In December 2021 she received a 20,000 bonus. She is provided with a diesel-engined company car (registered in January...

-

Create a Data Table to depict the future value when you vary the interest rate and the investment amount. Use the following assumptions: Interest Rates: Investment Amounts:-10.0% $10,000.00 -8.0%...

-

Isaac earns a base salary of $1250 per month and a graduated commission of 0.4% on the first $100,000 of sales, and 0.5% on sales over $100,000. Last month, Isaac's gross salary was $2025. What were...

-

Calculate the price, including both GST and PST, that an individual will pay for a car sold for $26,995.00 in Manitoba. (Assume GST = 5% and PST = 8%) a$29,154.60 b$30,234.40 c$30,504.35 d$28,334.75...

Study smarter with the SolutionInn App