Ivan (who is not a Scottish taxpayer) has the following income for tax year 2020-21: His personal

Question:

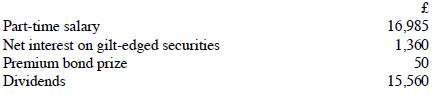

Ivan (who is not a Scottish taxpayer) has the following income for tax year 2020-21:

His personal allowance for 2020-21 is £12,500. Compute the income tax payable by Ivan for the year. How would this differ for a Scottish taxpayer?

Transcribed Image Text:

Part-time salary Net interest on gilt-edged securities Premium bond prize Dividends 16,985 1,360 50 15,560

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

To calculate the income tax payable by Ivan for the 202021 tax year as a nonScottish UK taxpayer we need to consider the UK income tax bands and rates ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Ivan (who is not a Scottish taxpayer) has the following income for tax year 2021-22: His personal allowance for 2021-22 is 12,570. Compute the income tax payable by Ivan for the year. How would this...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-6. On December 12, Irene purchased the building where her store is located. She paid...

-

A. Conduct keyword research for at least twenty phrases related to the client's business. Based on this research, recommend the three phrases that in your opinion should be used for the client's...

-

An auditorium measures 40.0 m X 20.0 m X 12.0 m. The density of air is 1.20 kg/m3. What are? (a) The volume of the room in cubic feet and (b) The weight of air in the room in pounds?

-

1 Participation: where practicable, encourage staff to take part in setting goals to increase their commitment to achieving them.

-

A factory producing an article P also produces a by-product Q, which is further processed into finished product. The joint cost of manufacture is as follows: Rs Materials 5,000 Labour 3,000 Overheads...

-

Suppose Nikes managers were considering expanding into producing sports beverages. Why might the company decide to do this under the Nike brand name?

-

Assignment: You were responsible for the proposal of the Desk Corp's Expansion. The building was built, equipment installed, staff hired and began operations in Q 1 . After 4 quarters of operations,...

-

Mary's income for tax year 2020-21 consists of business profits of 26,920, dividends received of 124,460 and rents received of 3,750. She is not a Scottish taxpayer and her personal allowance for the...

-

Ernest (who is not a Scottish taxpayer) has a retirement pension in 2020-21 of 56,890 and bank interest of 620. His personal allowance for the year is 12,500. Compute Ernest's income tax liability...

-

Diagram an experiment that shows pain-motivated aggression. LO3

-

A parent acquires all of the stock of a subsidiary for $40 million in cash. The subsidiarys books report the following account balances at the date of acquisition (in trial balance format)....

-

1. Given: The sign for the Inn of the Prancing Pony in Bree-yes, it comes in pints-is fixed on the end of a beam of length 5L. If the sigh deflects too much then Gandalf will hit his head when he...

-

Q21) Add positive and negative charges as shown in the diagram below. Use the arrows of the simulation to guide you in drawing continuous electric field lines around and in between the three charges....

-

When 10.1 g CaO is dropped into a styrofoam coffee cup containing 157 g H2O at 18.0C, the temperature rises to 35.8C. Calculate the enthalpy change of the following reaction in kJ/mol CaO. Assume...

-

4-12. Sometimes heterogeneous chemical reactions take place at the walls of tubes in which reactive mixtures are flowing. If species A is being consumed at a tube wall because of a chemical reaction,...

-

Examine the social media presence of a brand and assess whether it clearly identifies a brand positioning strategy.

-

As of January 1, 2018, Room Designs, Inc. had a balance of $9,900 in Cash, $3,500 in Common Stock, and $6,400 in Retained Earnings. These were the only accounts with balances in the ledger on January...

-

Jane is self-employed. Her recent adjusted trading profits/(losses) are: Jane has other income of 10,000 per annum. Assuming that the trading loss is carried forward and set against future trading...

-

Sally (who began trading many years ago and has not ceased trading) incurs an adjusted trading loss of 40,000 in the year to 31 December 2021. She has no capital gains. (a) What is her trading income...

-

Talat owns a large retail business and prepares accounts to 31 December each year. The written down value of his plant and machinery after deducting capital allowances for the year to 31 December...

-

Minden Company introduced a new product last year for which it is trying to find an optimal selling price. Marketing studies suggest that the company can increase sales by 5,000 units for each $2...

-

Prepare the adjusting journal entries and Post the adjusting journal entries to the T-accounts and adjust the trial balance. Dresser paid the interest due on the Bonds Payable on January 1. Dresser...

-

Venneman Company produces a product that requires 7 standard pounds per unit. The standard price is $11.50 per pound. If 3,900 units required 28,400 pounds, which were purchased at $10.92 per pound,...

Study smarter with the SolutionInn App