Toby is a widower. He was born in August 1933. His wife was born in June 1934

Question:

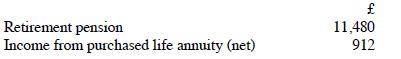

Toby is a widower. He was born in August 1933. His wife was born in June 1934 but she died in March 2020. Toby's income for 2020-21 is as follows:

Calculate the amount of income tax repayable to Toby for 2020-21.

Transcribed Image Text:

Retirement pension Income from purchased life annuity (net) 11,480 912

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

Retirement pension Income from annuity 912 10080 Total income Les...View the full answer

Answered By

Farsana Hussan

Hello,

I am Farsana Hussan.I completed my higher secondary education in commerce course with 96% marks.It contain english,computer application,economics,accountancy,bussiness studies and hindi subjects.Now i am studing in bachelore degree in economic subject.I have a lot of knowledge about these subject and i am interested with shareing my knoeledge with you all.Tutoring or answering questions is very interesting passion to me.

I am already working in many online plateforms for last 3 years with some works related to tutoring,shareing notes, etc. I am always here for giving a genuine solutions for your questions.

hope you consider me for answering your valuable question and consider me as a tutor...

Thank you all...

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

An inductor and a resistor are connected in series with a battery via a switch. Initially, the switch is open. At t = 0, the switch is closed. At t = 65.8 ms, = ()(der), dE dt DEL is the rate at...

-

Toby is a widower. He was born in August 1933. His wife was born in June 1934 but she died in March 2021. Toby's income for 2021-22 is as follows: 11,550 912 Retirement pension Income from purchased...

-

Toby is a widower. He was born in August 1932. His wife was born in June 1933 but she died in March 2017. Toby's income for 2017-18 is as follows: 10,480 912 Retirement pension Income from purchased...

-

Where is the line in the sand the point where such behaviors are so destructive that you feel that the relationship needs to end?

-

One gallon of paint (volume =3.78 X 10-3 m3) covers an area of 25.0 m2. What is the thickness of the paint on the wall?

-

1 Then reflect on the technique itself: did it give insight into the decision process? What other tasks should it include?

-

A product passes through three processes, processes I, II and III. 15,000 units of crude material were introduced into process I at Re 1 per unit. Additional information is as follows: Process I (Rs)...

-

A mixture of 54.5 mol% benzene in chlorobenzene at its bubble point is fed continuously to the bottom plate of a column containing two theoretical plates. The column is equipped with a partial...

-

Flounder Company had $153,300 of net income in 2016 when the selling price per unit was $150, the variable costs per unit were $90, and the fixed costs were $575,800. Management expects per unit data...

-

Brian and Daniel are civil partners. They were both born in 1976. Brian's total income for 2020-21 is 30,000 and Daniel's total income for the year is 10,000. None of their income is derived from...

-

Calculate the tax liability for 2020-21 of a husband and wife (both born in 1933), using the information below. No elections have been made in relation to the MCA and none of the income is derived...

-

Population data: 1, 2, 3, 4, 5, 6. a. Find the mean, , of the variable. b. For each of the possible sample sizes, construct a table similar to Table 7.2 on page 281 and draw a dotplot for the...

-

Salmone Company reported the following purchases and sales of its only product. Salmone uses a perpetual inventory system. Determine the cost assigned to the ending inventory using FIFO. 1 Date...

-

A company may go through organizational change at various stages in its life cycle for a variety of reasons. Reasons can include a change in ownership as well as a change in the competitive...

-

6 (a) Below is a diagram of a rotating disc viscometer (FIGURE 4). Explain its operations and limitations as to use. If, in a similar works situation, it is necessary to make measurements on a...

-

As part of your role in the Business Analytics and Data Analytics team, you have been asked to forecast Food Retailing as part of a wider report being commissioned by the above collaboration - on...

-

You are three students who have together bought a business that makes snow. The customers consist of both large public enterprises and private individuals. The business is run all year round, but the...

-

Why is it valuable for VW to have many different creative themes across all of its brands?

-

On January 1, 2018, Khalid Ltd., which follows IAS 17, entered into an eight-year lease agreement for three dryers. Annual lease payments for the equipment are $28,500 at the beginning of each lease...

-

Rosemary's capital gains and losses in recent years (and the annual exemption for each year) have been as follows: There were no unrelieved losses to bring forward from 2017-18 or earlier. Compute...

-

On what date is CGT for 2021-22 normally due for payment?

-

John dies on 3 March 2022. Between 6 April 2021 and 3 March 2022, he has capital gains of 1,200 and capital losses of 15,400. His net gains in recent tax years (and the annual exemption for each...

-

Flexible manufacturing places new demands on the management accounting information system and how performance is evaluated. In response, a company should a. institute practices that reduce switching...

-

Revenue and expense items and components of other comprehensive income can be reported in the statement of shareholders' equity using: U.S. GAAP. IFRS. Both U.S. GAAP and IFRS. Neither U.S. GAAP nor...

-

Kirk and Spock formed the Enterprise Company in 2010 as equal owners. Kirk contributed land held an investment ($50,000 basis; $100,000 FMV), and Spock contributed $100,000 cash. The land was used in...

Study smarter with the SolutionInn App