Stephanie (who is not a Scottish taxpayer) has the following income in 2021-22: Compute Stephanie's income tax

Question:

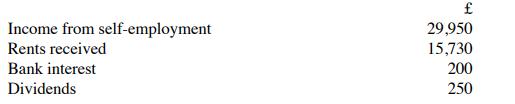

Stephanie (who is not a Scottish taxpayer) has the following income in 2021-22:

Compute Stephanie's income tax liability for the year, assuming that the rents received are not within the "rent-a-room" scheme and that Stephanie is entitled to the personal allowance of £12,570. How would this differ for a Scottish taxpayer?

Transcribed Image Text:

Income from self-employment Rents received Bank interest Dividends 29,950 15,730 200 250

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

Calculating Stephanies UK income tax liability for the 202122 tax year involves understanding the UKs tax bands and rates for that year However its important to note that due to differences in Scottis...View the full answer

Answered By

Nimlord Kingori

2023 is my 7th year in academic writing, I have grown to be that tutor who will help raise your grade and better your GPA. At a fraction of the cost on other sites, I will work on your assignment by taking it as mine. I give it all the attention it deserves and ensures you get the grade that I promise. I am well versed in business-related subjects, information technology, Nursing, history, poetry, and statistics. Some software's that I have access to are SPSS and NVIVO. I kindly encourage you to try me; I may be all that you have been seeking, thank you.

4.90+

360+ Reviews

1070+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

A boat is heading towards a lighthouse, whose beacon-light is 145 feet above the water. The boat's crew measures the angle of elevation to the beacon, 11. What is the ship's horizontal distance from...

-

Matt Lim is a 45-year-old Singaporean. He has been working for Micro Inc (Micro), a company tax resident in Country X for the past 10 years. Micro is listed on the Stock Exchange of Country X. To be...

-

A taxpayer has the following income (losses) for the current year: What is the taxpayers taxable income (loss) if a. The taxpayer is a publicly held corporation? b. The taxpayer is a closely held...

-

Based on the following definitions, which statement is NOT true? int[] 1DArray={1,2,3}; int[][] 2DArray=new int[2][]; 2DArray[0]={4,5}; 2DArray[1]={6,7,8}; public void method1(int[] 1DArray){...}...

-

Prove that if A attracts B, then A repels B .

-

The following expenditures relating to long-term assets were made by Kosinski Sandwiches during the first two months of 2004. LO9 1. Paid $5,000 of accrued taxes at time his restaurant site was...

-

20-2. En qu consiste la administracin de ventas ?

-

Weinstein, McDermott, and Roediger (2010) report that students who were given questions to be answered while studying new material had better scores when tested on the material compared to students...

-

Submit a paper that is 2-3 pages in length (no more than 4-pages), exclusive of the reference page. The paper should be double spaced in Times New Roman (or its equivalent) font which is no greater...

-

Ernest (who is not a Scottish taxpayer) has a retirement pension in 2021-22 of 57,160 and bank interest of 620. His personal allowance for the year is 12,570. Compute Ernest's income tax liability...

-

Calculate the 2021-22 income tax liability of a non-Scottish taxpayer with income for the year as follows: (a) Business profits of 28,175 and bank interest of 720. (b) Business profits 50,420,...

-

Use the data in Exercise 25 of Section 1 Exercises 1320 refer to the tables in the Section 1 Exercises. In each case, do the following.

-

The current rate of interest on S-T Treasury Bills = 10%, intermediate term Gov. Bonds = 11%, Lt- Gov. Bonds = 12%, AA rate Corp. Bonds = 13.5% and the rate of inflation is 5%. Holding-period returns...

-

Prepare Income Statement(absorption costing) for the second, third and fourth month. SALES (SP X unit sold) INCOME STATEMENT FORMAT (ABSORPTION COSTING) XXX Less: Cost of Goodsold VARIABLE COST (VC...

-

The following shows the distribution of final exam scores in a large introductory psychology class. The proportion under the curve is given for two segments (short answers-no calculations required)....

-

How much overhead was included in the cost of Job #461 at the beginning of January? * (1 Point). BREAD Co. uses a job order costing system. At the beginning of January, the company had 2 jobs in...

-

3. (3pt.) A state of a physical system is just a description of the system at an instant in time in terms of its properties. In classical mechanics, states are represented by points (in phase space)....

-

The following data represent the responses to two questions asked in a survey of 40 college students majoring in business: What is your gender? (M = male; F = female) and What is your major? (A =...

-

The age-old saying for investing is "buy low and sell high," but this is easier said than done. Investors who panic about falling prices sell their investments, which in turn lowers the price and...

-

On 1 January 2019, a company which prepares accounts to 31 December grants "share appreciation rights" to 30 of its employees. By virtue of these rights, the employees concerned will become entitled...

-

Baxen is a public limited company that currently uses local accounting standards for its financial reporting. However, the board of directors of Baxen is considering the adoption of IFRS in the near...

-

Assuming that today's date is 1 January 2023, calculate the present value of each of the following (using a discount rate of 7% in each case): (a) 50,000 to be received on 1 January 2026 (b) 100,000...

-

On January 1, 2018, Brooks Corporation exchanged $1,259,000 fair-value consideration for all of the outstanding voting stock of Chandler, Inc. At the acquisition date, Chandler had a book value equal...

-

1. Determine the value of the right to use asset and lease liability at commencement of the lease.

-

Problem 22-1 The management of Sunland Instrument Company had concluded, with the concurrence of its independent auditors, that results of operations would be more fairly presented if Sunland changed...

Study smarter with the SolutionInn App