Following is information from General Mills fiscal 2011 first quarter results: a. What is the difference between

Question:

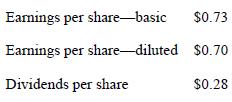

Following is information from General Mills’ fiscal 2011 first quarter results:

a. What is the difference between the two earnings per share for General Mills for the period reported?

b. What is meant by the dividends per share?

c. Based on dilutive earnings per share, what is the dividend payout ratio?

Transcribed Image Text:

Earnings per share-basic Earnings per share-diluted Dividends per share $0.73 $0.70 $0.28

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (6 reviews)

a The difference between the two earnings per share for ...View the full answer

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

The Theory And Practice Of Investment Management

ISBN: 9780470929902

2nd Edition

Authors: Frank J Fabozzi, Harry M Markowitz

Question Posted:

Students also viewed these Business questions

-

Holmes Corporation is a leading designer and manufacturer of material handling and processing equipment for heavy industry in the United States and abroad. Its sales have more than doubled, and its...

-

AT&T spun off its research and development division (the former Bell Laboratories) in April of 1996, and the newly independent company - renamed Lucent Technologies - was an instant hit with...

-

Access the consolidated financial statements for Dollarama Inc. for the year ended January 31, 2021, from the companys website or from SEDAR (www.sedar.com). Refer to these statements to answer the...

-

Angelo Bank is planning to replace some old ATM machines and has decided to use the York Machine. Anita Chavez, the controller, has prepared the analysis shown here. She has recommended the purchase...

-

The balance of Cash is likely to differ from the bank statement balance. What two factors are likely to be responsible for the difference?

-

Suppose the demand function for a product is P = 100 - (1/6)Q + 2I, where I is income and the supply function is P = (1/3)Q. Currently I = 25. a. Find the current equilibrium price and quantity. b....

-

Genetics A Punnett square is a diagram that shows all possible gene combinations in a cross of parents whose genes are known. When two pink snapdragon flowers (RW) are crossed, there are four equally...

-

Woodmier Lawn Products introduced a new line of commercial sprinklers in 2010 that carry a one-year warranty against manufacturer's defects. Because this was the first product for which the company...

-

Company XYZ is a footwear manufacturer. The company sells these products for high sales prices. Though the company was highly profitable in the past, is facing steeply rising costs in raw materials....

-

What is the basic idea behind a dividend discount model?

-

What are the main challenges involved in deciding how much to allocate to the performance-seeking portfolio versus the liabilityhedging portfolio?

-

Pigskin: In football, a turnover occurs when a team loses possession of the ball due to a fumble or an interception. Turnovers are bad when they happen to your team, but good when they happen to your...

-

The figure shows a turbine-driven pump that provides water, at high pressure, to a tank located 25-m higher than the pump. Steady-state operating data for the turbine and the pump are labelled on the...

-

Step 1 Step 2 1. Sketch what step 4 and then step 5 would look like. Step 4 Step S 2. How many black triangles are in each step? Step 1 black A = | Step 2 = 4 black A's step 3 = 13 black D's 3. What...

-

The pressure cooker pictured here consists of a light pressure vessel with a heavy lid of weight W. When the lid is secured, the vessel is filled with a hot pressurized gas of pressure p. After some...

-

5) A large group of students took a test in Finite Math where the grades had a mean of 72 and a standard deviation of 4. Assume that the distribution of these grades is approximated by a normal...

-

Q9 (5 points) According to Dr. Henry Mintzberg, a noted management scholar from McGill University in Montreal, PQ, "business organizations perform only two activities of consequence." What are these...

-

The first of a series of equal, monthly cash flows of $2000 occurred on April 1, 1998, and the last of the monthly cash flows occurred on February 1, 2000. This series of monthly cash flows is...

-

During the year land was revalued and the surplus reported as Revaluation surplus; and an asset costing 80,000, written down to 38,000, was sold for 40,000. Identify the cost of any non-current...

-

Is there any difference between a brand name and a trademark? If so, why is this difference important?

-

Is a well-known brand valuable only to the owner of the brand?

-

Suggest an example of a product and a competitive situation where it would not be profitable for a firm to spend large sums of money to establish a brand.

-

assume that we have only two following risk assets (stock 1&2) in the market. stock 1 - E(r) = 20%, std 20% stock 2- E(r) = 10%, std 20% the correlation coefficient between stock 1 and 2 is 0. and...

-

Flexible manufacturing places new demands on the management accounting information system and how performance is evaluated. In response, a company should a. institute practices that reduce switching...

-

Revenue and expense items and components of other comprehensive income can be reported in the statement of shareholders' equity using: U.S. GAAP. IFRS. Both U.S. GAAP and IFRS. Neither U.S. GAAP nor...

Study smarter with the SolutionInn App