(a) The new projects value is $11/1.15 $9.57. At a cost of $10, the net present...

Question:

(a) The new project’s value is $11/1.15 ≈ $9.57. At a cost of $10, the net present value is −$0.43.

(b) The value today of the new project is $11/1.15 ≈ $9.57. Therefore, the weight of the new project is wnew

= PVnew/PVcombined

≈ $9.57/$109.48 ≈ 8.74%.

(c) The beta of the combined firmis βcombined

= wold . βold

+ wnew . βnew

≈ 91.26% . 0.5 + 8.74% . 3 ≈

0.719.

(d) The combined cost of capital according to the CAPM is E(˜rcombined) ≈ 3% + 4% . 0.719 = 5.876%.

(e) Yes! The IRR of new is 10%. (For IRR, see Chapter 5, page 90.) 10% is above the blended cost of capital of 5.876%.

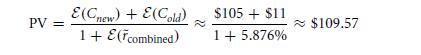

(f) The firm value would be

Again, you conclude that the firm has destroyed $0.43.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: