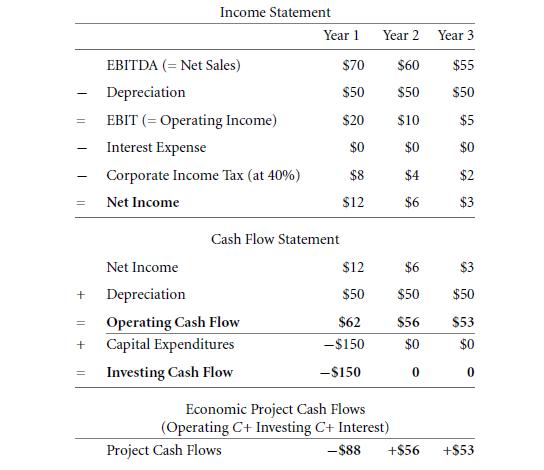

For our 3-year project firm: (a) The pro forma for a 100% equity-financed firm is shown below.

Question:

For our 3-year project firm:

(a) The pro forma for a 100% equity-financed firm is shown below.

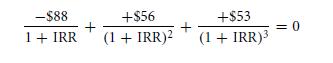

(b) The IRR of our project solves

Thus, the IRR of a purely equity-financed project is 15.69%.

(c) The NPV of the purely equity-financed project is![]()

This is in line with the fact that the project IRR of 15.69% is less than the 18% cost of capital.

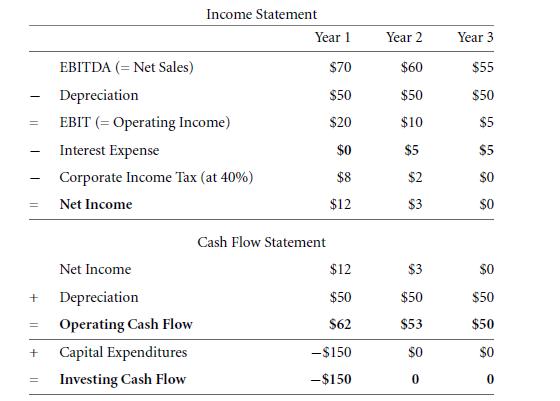

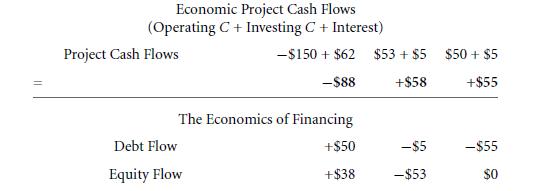

(d) The cash flows would increase to −$88, +$58, and +$55. The IRR would increase to 18.61%.

(e) The debt-financed pro forma would now be as follows:

Not surprisingly, these are the same as the aforementioned cash flows, with a $2 income tax subsidy in years 2 and 3. The IRR is again 18.61%.

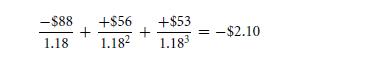

(f) The NPV of the debt-financed firm is![]()

With the tax subsidy, this project becomes worthwhile.

(g) The APV of this project would start with the as-if-100%-equity-financed value. This was computed above as

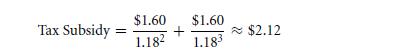

For APV, now add the discounted tax subsidies in years 2 and 3. These have a value of![]()

Therefore, the APV would be −$2.10 + $2.65 = $0.55.

(h) By APV, the expected tax subsidy would shrink from τ . E(Interest Payment) = 40% . $5 = $2 per year to τ . E(Interest Payment) = 40% . $4 = $1.60 per year. The expected value of the tax subsidy would therefore be

The net project value would be about $0.02.

(i) You can see that after year 2 and before year 3, the debt is expected to be 100% of the capital structure.

However, in year 1, with debt contributing $50, it is obviously not 0% of the firm. Thus, its weight in the capital structure is drastically changing. This firm is not at all a good candidate for usingWACC.

P.S.: Please do not try to compute a weighted average cost of capital from the debt and equity internal rates of return (10% and 40%, respectively). If the debt would be at 57% of the firm’s capital structure, then the appropriate rate of return of equity would have to be around 30% so that the weighted cost of capital would come out to E(˜rFirm) = wDebt . E(˜rDebt) + wEquity . E(˜rEquity) = 18.6%. This is much lower than the equity IRR of 40% (which is the same as its expected rate of return from year 1 to year 2), because from year 2 to year 3, the equity becomes a much smaller part of the firm. What bites you in this case is the fact that you have a strong term structure of investment weights.

Step by Step Answer: