At its annual meeting in March 2014, the shareholders of Jasper Inc. (Jasper) approved a plan allowing

Question:

At its annual meeting in March 2014, the shareholders of Jasper Inc. (Jasper) approved a plan allowing the company’s board of directors to grant stock options to certain employees as part of their compensation packages. During the year ended December 31, 2014, the board granted 200,000 options to its senior executives. The stock options were issued when Jasper’s shares had a market price of \($22\) per share. The exercise price of the options is \($24\) per share. During fiscal 2014, Jasper earned revenues of \($37,345,000\) and had cost of sales of $18,525,000; selling, general, and administrative expenses of $4,560,000; interest expense of $3,535,000; other expenses of $5,700,000; and an income tax expense of \($1,340,000\). The economic value of the stock options when they were issued was

$1,200,000.

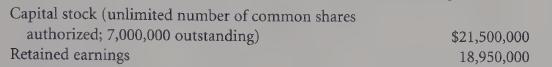

On December 31, 2013 the equity section showed the following:

During fiscal 2014, Jasper didn’t issue or repurchase any common shares. Dividends of \($0.10\) were declared and paid during the year.

Required:

a. Prepare Jasper’s income statement for the year ended December 31, 2014.

b. Calculate basic earnings per share and return on shareholders’ equity assuming the value of the stock options is expensed when granted and assuming they aren’t expensed.

c. What effect do the two treatments for employee stock options have on cash flow?

d. Which accounting approach do you think Jasper’s managers would prefer? Explain.

e. Which approach do you think gives a better representation of Jasper’s economic performance?

f. If Jasper didn’t accrue the cost of the options in its financial statements, what information would you want disclosed about them? Explain.

Step by Step Answer: